Ethylene glycols (mono-, di-, tri- and poly-) are vital as versatile intermediates used in a wide range of applications. They are central for the production of such important polymers as polyethylene terephthalate (used as polyester fibre and packaging products, e.g. plastic bottles) and polybutylene terephthalate (used for high-quality construction materials, especially in car marking and electrical goods). Ethylene glycols are characterised by high boiling points, hygroscopic capacity, non-corrosiveness, freeze point depression, as well as lubricating, plasticising and solvent properties.

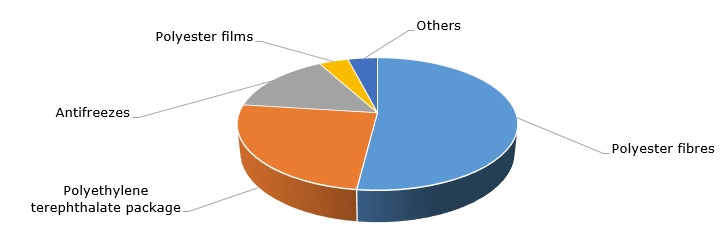

Ethylene glycol: structure of the global consumption structure

Monoethylene glycol (MEG) is extensively used in the polyester industry to manufacture polyester filament yarn and polyester staple fibre. Globally, the polyester fibre sector remains the largest outlet for MEG and ethylene glycols in general. MEG is also employed in the production of antifreeze solutions, explosives, dehydrating agents, industrial solvents, cosmetics, printing inks, etc.

The market for monoethylene glycol is noted for its volatility. Exacerbated by the Covid-19 outbreak, the current turbulent macroeconomic situation enhances this volatility. The segments of durable commodities, mobility, and retail have experienced a significant negative impact, while the sectors of food products, beverages, personal care, and hygiene items have performed quite well during the pandemic. Several factors are also critical now. August is a traditional month for planned maintenance turnarounds at many oil refineries, which generally tightens the supply of MEG, including the supply of ethylene oxide (EO), MEG’s main feedstock, thus firming MEG and EO prices. For instance, MEGlobal’s Asian Contract Price (ACP in USD/mt CFR main Asian ports) for MEG rose from $570/mt in June 2020 to $590/mt in July-August 2020 (the ACP for September 2020 is scheduled to reach $620/mt). MEGlobal (owned by the EQUATE Group) is a world leader in the manufacture, supply, and marketing of MEG and diethylene glycol with its own ethylene glycol production capacity of over 2 mln mt/y (located in the USA and Canada). Eastman Chemical has confirmed a $0.04/kg rise in ethylene glycol price in North America and Latin America for September 2020. The demand for MEG in the US in August 2020, especially in the antifreeze, PET, and hygiene fibres sectors, remained strong. Due to tight supplies, MEG prices in Europe also continue to go up.

At the same time, late summer at various regional markets is a period when the polyester industry slows down on lower demand, while different MEG manufacturers tend to reduce their capacity utilization rates (though the current MEG inventories, incl. in China, remain high). So, the present state of the global MEG market is characterised by a fragile state of equilibrium, where several key trends are present. On the one hand, there is a decrease in demand for MEG in some downstream sectors. This decrease is induced by seasonal factors and the economic slowdown due to the COVID-19 pandemic. However, other sectors in certain regions (e.g. antifreeze solutions in the US) exhibit stronger demand. On the other hand, the MEG market encountered with tightened supply, which provides modest upward pressure on prices at various regional markets. The demand for MEG in various consuming sectors may pick up as the global economy continues to restore after lockdowns, though this process could hardly be instantaneous.

Find more information on the global monoethylene glycol (MEG) market in the insightful research study “Monoethylene Glycol (MEG): 2020 World Market Outlook and Forecast up to 2029”.