Magnesium compounds, primarily magnesium oxide, are used mainly as refractory materials. The key refractory markets for magnesium oxide by industry are steel (about 70%), cement and lime, ceramics, metals, glass, chemicals, and others. The major producer of magnesium compounds is China, with over 50% of the market. Magnesium oxide and other compounds are also used in various non-refractory sectors, including agriculture, chemical industry, construction, environmental area, pharmaceuticals, cosmetics, to name only a few.

The versatility of magnesium applications is a powerful factor preventing the market for magnesium compounds from shocks, like the ongoing Covid-19-induced instability. Another strong factor that keeps the current upheaval at bay is the process of continuous innovation demonstrated by multiple companies in the field of magnesium products. Moreover, innovations penetrate each element of these companies’ operations, including production, research, distribution, and related services.

A vivid example of an innovative approach is the activity of a Dutch company, Nedmag. Nedmag specialises in the production of high-quality dead burned magnesium oxide, magnesium chloride, magnesium hydroxide suspension, and calcium chloride (a by-product of magnesium oxide production). The Netherlands is a major producer of magnesite from seawater or brines. Nedmag is currently involved in the production of magnesium additives to reduce the use of nitrogen fertilizers, decrease nitrogen emissions, and improve the nitrogen cycle in soils. In implementing this idea, Nedmag collaborates with Farmin BV, an exclusive distributor of Nedmag’s magnesium chloride of natural origin.

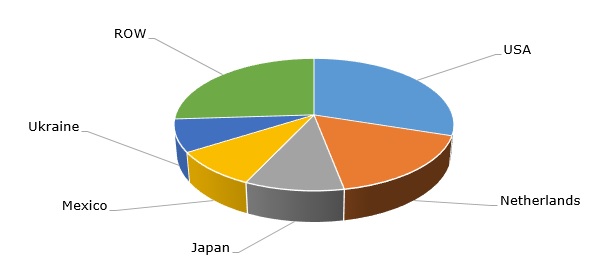

Structure of the global production capacity of magnesite derived from seawater or brines, by country

The production of magnesium compounds is a highly energy-intensive process. For example, refractory (or dead-burned) magnesite is produced by calcining magnesite or magnesium hydroxide at temperatures greater than 1450°C, while fused magnesia is produced by melting high-purity natural magnesite in an electric arc furnace at temperatures of up to 3000°C. Nedmag is implementing measures to reduce this intensity by substituting natural gas with green hydrogen since electrification of the manufacturing processes is often not an option. The first field demonstration of using hydrogen for this purpose by Nedmag is scheduled for Q4 2020. This became possible due to the collaboration with an industry consortium initiated by DNV GL and other partners (incl. the Dutch government) for the gradual transition from natural gas to hydrogen.

As is clear from the above examples of Nedmag’s operation, the theme of environmental protection is of major significance. It directly affects the sector of magnesium and its compounds. For instance, in April 2017, SYMC, the Pingyao-based operating subsidiary of Sovran White International Limited (formerly China Magnesium Corporation), has to stop its production to comply with emissions standards imposed by the Ministry of Environmental Protection of China. These standards affected the work of a variety of production plants, including magnesium plants. Later, Sovran White International implemented significant measures to comply with these regulations. Sovran White International is a major magnesium manufacturer in China.

The above examples confirm that strong fundamentals of the market for magnesium products hinge on the versatility of their application, innovative character of the operation of related companies, and active collaboration with different stakeholders.

More information on the global market for magnesium and its compounds can be found in the insightful research study “Magnesium and Compounds: 2020 World Market Review and Forecast to 2029”.