Polybutylene terephthalate (PBT) belongs to the class of polyesters within a broader category of polycondensates. Being a high-performance engineering plastic material with advanced parameters in rigidity and strength, abrasion/heat/hydrolysis resistance, processing capacity, flame retardancy, and dimensional stability, it is widely applied in multiple industries, like automaking, household appliances, packaging, or electrical applications. Its key production methods include either polycondensation of terephthalic acid or transesterification of terephthalic acid dimethyl ester with 1.4-butanediol. It is worthwhile mentioning here that terephthalic acid market dynamics is mostly driven not by PBT, but by another high-performance engineering plastic of the same class, which is polyethylene terephthalate (PET).

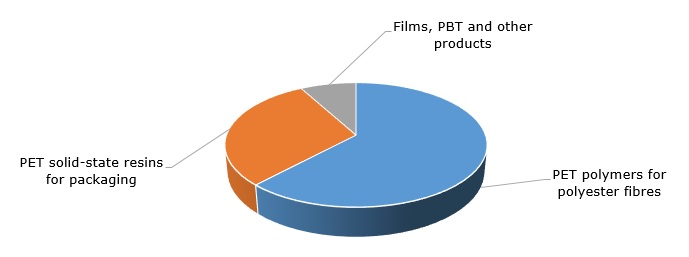

Structure of the global terephthalic acid consumption

Major PBT manufacturers (with their respective tradenames) are as follows: BASF (e.g. tradename: Ultradur), SABIC (Enduran), DSM (Arnite T), Lanxess (Pocan), Polyplastics (Duranex), Evonik (Vestodur), Toray (Toraycon) and DuPont (Crastin), to name only a few. It goes without saying that, common to other polymers, these PBT tradenames are available in multiple grades subject to an application sector or specific customer needs.

The COVID-19-driven crisis exerted a significant negative impact on various PBT-consuming sectors and the chemical industry in general. It is evident from the analysis of the financial performance of PBT-manufacturing companies in H1 2020. For instance, the sales and production volumes demonstrated by DSM corporation within the “Materials” business cluster (responsible for high-performance engineering plastics) dropped by 16% and 14%, respectively, as high-performance plastics sales were severely impacted by the lockdowns and demand decrease, especially in their largest end-market, the global automotive industry. Some sources report about the gradual recovery of the automotive sector after the significant spring and summer-fall, which might render a positive effect on PBT consumption. However, other sources predict a bumpy road ahead for the car industry. In the long-term perspective, the automotive industry will continue to drive the demand for PBT, specifically due to the growing demand for electric vehicle sensors. Another potential growth sector for PBT is the launch of 5G services in different countries, which will require low dielectric PBT with low transmission losses.

In late October 2020, the demand for PBT in different regions (e.g. China, some EU countries) and specific sectors (e.g. packaging and medical applications) demonstrated a slight rise from rather stagnant levels in September. The PBT market is currently witnessing the increase in purified terephthalic acid and butanediol prices, which may also signify about slow, though very unstable, recovery of the markets. This recovery is hindered by multiple uncertainties associated with rising Covid-19 numbers in many countries, unclear results of the post-Brexit trade deal talks, and possible reinvigoration of China-US trade discrepancies.

More reliable information on the global polybutylene terephthalate market can be found in the insightful research report “Polybutylene Terephthalate (PBT) 2020 Global Market Review and Forecast to 2029”.