Polyphthalamide (PPA) represent a group of multi-functional thermoplastic synthetic resins, which belong to the class of crystalline semi-aromatic polyamides with aromatic groups in their polymer backbones. They, especially when blended with other polymers, demonstrate good dimensional and heat stability (it is crucial in automotive applications under harsh conditions with elevated temperatures), improved solvent resistance, great tensile strength, higher melting point and glass transition temperature, low moisture absorption, and increased processability. Therefore, PPA often surpasses other engineering plastics, like polyamide 66, with respect to mechanical and thermal properties. As other polyamides, PPA pertains to the cohort of mostly or partially recyclable plastics, though it could hardly be degraded under normal conditions, thus requiring hydrothermal treatment.

Like with all polymers, the applicability of polyphthalamide and their composite materials can be really wide and diverse with a prominent role in car making, electrical and electronic components, aircraft industry, papermaking, home appliances, tubing, to name only a few. To this extent, each PPA brand is a family or series of products and solutions adjustable for a specific application area and customised needs. Among key PPA brands, one can mention Solvay’s Amodel (this brand of engineering resins was bought by Solvay from BP Amoco in 2000 together with BP Amoco facilities), Arkema’s Rilsan (the brand is a long-existing and very versatile product family with a robust R&D basis and strong commercial potential) or DuPont’s Zytel HTN (a portfolio of high-end specialty polymers, which is in constant development and cross-fertilization with new technologies).

The current macroeconomic instability, driven by the COVID-19 pandemic, Brexit, and the US turbulent elections, negatively affects the market for polymers and engineering plastics with their outlets in automobility, aerospace, construction, retailing, petroleum industry, and other sectors. For instance, within Q1-3 2020, the net sales of the afore-mentioned Solvay dropped by 13.5% as compared to the same period a year earlier. In Q3 2020, Solvay’s specialty polymers sales went down by 13.6%, while composite materials sales declined by 44.3%, driven by lower demand in aero, auto, oil/gas, and construction markets, partially offset by the growth in healthcare, electronics, and the electric car battery segment. In May 2020, the company announced the closure of composite materials plants in Manchester (the UK) and Tulsa (Oklahoma, the US) because of lower customer demand due to COVID-19.

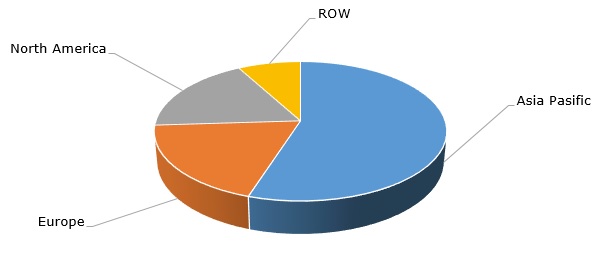

Structure of the global demand for polyphthalamide by region

The financial losses incurred by another major PPA manufacturer, Arkema, in Q2 2020 were on par with those of Solvay, while Q3 2020 witnessed some recovery, which is overshadowed in Q4 2020 by the second wave of the pandemic in many countries. The versatility of Arkema’s products was responsible for strong company’s resilience. The company predicts that its high-performance polymers segment, including specialty polyamides, should perform well within the coming months as demand for these products is returning. Of course, the demand for PPA is mostly driven by the Asia Pacific region and specifically by China, where economic recovery is currently ongoing with its manufacturing sector is now back to pre-COVID levels of capacity utilization rates.

More cutting-edge information on the global polyphthalamide market can be found in the insightful research study “Polyphthalamide (PPA) 2020 Global Market Review and Forecast to 2029”.