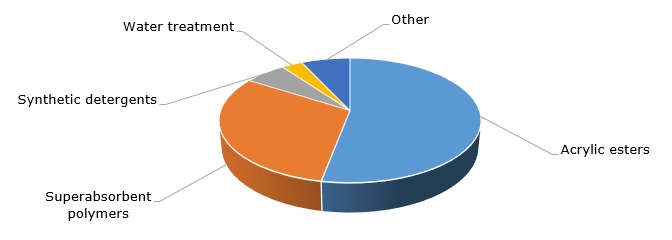

Acrylic acid is an important chemical compound, which acts as an element of extensive value chains with end uses in products like plastics, paints, textiles, lacquers, coatings, surfactants, adhesives, detergents, water treatment products, hygiene items, to name only a few. The production of acrylates, i.e. acrylic esters (e.g. butyl acrylate, ethyl acrylate, methyl acrylate, etc.) and salts is a major output for acrylic acid. Acrylates participate in the synthesis of polymers as either linking together monomers to form homopolymers or by bonding via copolymerization with other monomers (e.g. vinyl, styrene, and butadiene). It is logical to ascertain that high variability of acrylic polymer products becomes possible due to a wide array of adjustments available in polymer chemistry. Such adjustments can include variations in a polymerization degree, architecture of chains, or monomer sequence. Superabsorbent polymers (SAP), a class of cross-linked hydrophilic polymers, is another popular outlet for polyacrylate polymers and precursor acrylic acid as well. Cross-linked sodium acrylate is a vital product for SAP manufacture.

Structure of the acrylic acid consumption by applications

The petrochemical industry, specifically the production of propylene as a by-product of oil-refining processes, forms the basis of acrylic acid production, though bio-based production routes (e.g. a fermentation process) have been in development for some time now. Sustainable production of acrylic products is not limited to the use of bio-based fermented feedstock. For instance, BASF currently experiments with the use of CO2 as a feedstock to substitute 30% of fossil fuels in an alternative production of sodium acrylate. BASF is the world’s largest producer of acrylic acid (with a total capacity of 1.51 mln mty) with six sites for acrylic monomer production in key economic areas [Belgium, Brazil, China (JV), Germany, Malaysia (JV), and the USA).

Sustainability-oriented innovations underpin a bright future of the market for acrylic acid and its products. With such prospects in mind, key acrylics companies are very much interested in the development of acrylics value chains. For example, BASF upgraded its polyacrylate production in Ludwigshafen, Germany by 2020. In cooperation with Adani Group, the company plans a future acrylics project in Mundra (India) to be realised by 2025, though only a memorandum of understanding has been signed so far and the current COVID-19 pandemic currently put the project on hold.

Arkema, BASF’s close rival on the acrylics market, also sees large potential for growth in this market. In 2019, Arkema launched a new 90,000 mty acrylic acid reactor at its production site in Clear Lake (Texas) to substitute the outdated facilities. The same year, Arkema acquired its partner’s stake in Taixing Sunke Chemicals, which was a joint venture with Taixing Jurong established in 2014 for manufacturing acrylic monomers in China. The Taixing site has a crude acrylic acid capacity of 480,000 mty.

It is clear that these market decisions mainly preceded the current COVID-affected uncertain situation, which had a detrimental effect on nearly all markets, except some niche sectors. For instance, Arkema’s sales in Q3 2020 were EUR 1,9 bn as compared to EUR 2,3 bn in Q3 2019. Nearly all markets remain subdued, which clearly feeds back into the recent slump in the oil and petrochemical prices. The decrease in the demand for acrylics is evident in all markets, including China and the USA. However, the market fundamentals for acrylic monomers remain strong, while the arrival of an effective vaccine against COVID-19 may invigorate the markets in 2021.

More reliable information on the global acrylic acid market can be found in the in-demand research report “Acrylic Acid: 2020 World Market Outlook and Forecast up to 2029”.