The essential need in food security and the growing demand for agricultural products has laid the groundwork for the phosphate market development. Phosphate rock is used predominantly (up to 95%) in the production of different types of fertilizers (both solid and liquid) and animal feed, while its small amount is applied to manufacture various industrial products. Despite the current macroeconomic and geopolitical instability, the phosphate industry performs relatively well as compared to many other industries despite the tangible losses in the whole fertilizer sector. For example, Nutrien, a major Canadian manufacturer of potash, nitrogen, and phosphate products, reported a fall in its revenue in Q3 2020, and especially from its phosphate operations. The company linked this fall primarily to a less favourable outlook for phosphate prices and imbalances associated with phosphate supplies. In general, the prices for phosphate and potash fertilizers have been steadily declining since 2012 (the previous peak of phosphate prices occurred in 2007-2008, prior to the economic slowdown). Nutrien anticipates some issues with phosphate supplies, but the company is self-sufficient in phosphate rock due to its six US-based phosphate production facilities, including three mines / mineral-processing plants, especially its facilities in Aurora, North Carolina, and White Springs, Florida. Nutrien is the world’s fourth-largest phosphate manufacturer, following OCP Group (Morocco), Mosaic (the US), and Ma’adan (Saudi Arabia).

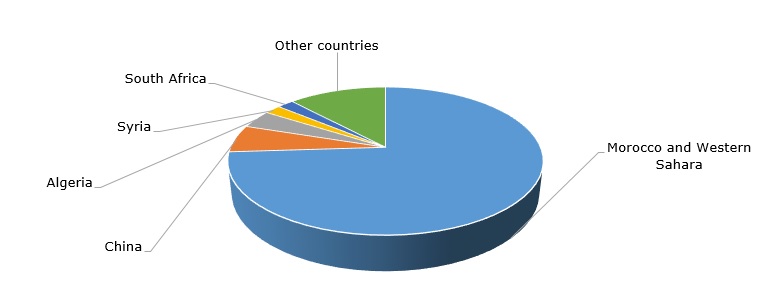

Large-scale phosphate production (with outputs over 500k mty) occurs in more than 40 countries. However, both production and reserves of phosphates spread unevenly around the globe. Morocco and Western Sahara account for nearly three-quarters of global phosphate reserves. Meanwhile, phosphate production in Morocco and Western Sahara is much smaller than in China (33 mln tonnes against 110 mln tonnes, respectively), whereas Chinese phosphate reserves are significantly lower than in Morocco (3.2 bn tonnes against 50 bn tonnes, respectively). It is worth mentioning here that, according to some sources, the Chinese government might exaggerate its official stats data for phosphate production volumes.

Global reserves of phosphate rock

The market for fertilizers in Africa has enormous potential. The continent is home to the world’s largest phosphate reserves, while its current levels of fertilizer consumption remain extremely low, which is paralleled by quick changes in the lifestyle and consumer habits in many African countries. The immaturity of the market and the lack of phosphate rock processing capacities are key barriers preventing the local phosphate industry from development. Therefore, African countries prefer to grant phosphate mining and processing concessions to multinationals. For instance, the government of Togo provided a concession to Elenilto Group (Israel) and Weng Fu Group (China) to mine its phosphate reserves, which are estimated at approximately 2 bn tonnes.

The uneven spread in production and reserves dictates the need for vertical integration (including retail activities), innovation, and a permanent search for cost reduction. It also augments competition between various regional markets and players. For instance, in late November 2020, the U.S. Department of Commerce imposed preliminary countervailing duties of 23.46% on the U.S. imports of Moroccan phosphate fertilizers (for Moroccan producer OCP) in response to a petition from the Mosaic Company. Apart from penalizing Moroccan imports, the duties were imposed against Russian manufacturers, specifically against PhosAgro and EuroChem (20.94% and 72.5%, respectively), and for all other Russian producers/exporters at a rate of 32.92%. By late March 2021, the U.S. International Trade Commission will also decide if Moroccan and Russian imports of phosphate fertilizers negatively affect the same sector in the USA.

All these issues, including significant price fluctuations, the uneven spread of resources, augmented competition, overproduction, and protectionist tariff policy, paralleled by the rising need for agricultural products and sustainable application of fertilizers, characterise the dynamics of the phosphate market. Currently, the market has to cope with the increased macroeconomic instability driven by the Covid-19 pandemic. However, the fertilizer industry is well-positioned to combat these challenges.

More cutting-edge information on the global phosphate rock market can be found in the in-demand research report “Phosphate Rock: 2020 World Market Review and Forecast to 2029”.