The application of sodium chlorate (NaClO3), also known as chlorate of soda, is predominantly orientated at two segments. Firstly, it is used in chlorine-free pulp bleaching in the pulp and paper industry. It is considered to be an environmentally preferred alternative to chlorine to whiten paper products, though sodium chlorate toxicity to the environment is well documented. Secondly, sodium chlorate is used in harvest aids or herbicides (mainly defoliants or crop desiccants). The latter refers to the use of sodium chlorate as a phytotoxic chemical to destroy various weeds or inhibit their growth. In this weed-killing capacity, sodium chlorate has been banned in the EU since 2010 due to severe toxicity of this chemical, though some cases of its illegal sales and use afterward (actually almost 10 years later) were reported. Other minor applications of sodium chlorate include surface treatment of metals, use in the extraction of uranium and vanadium, etch regeneration in electronics, etc.

The current prospects of the sodium chlorate market remain mixed. For instance, more than five years ago, Tronox, a manufacturer of sodium chlorate, shut down its sodium chlorate facility in Hamilton, Mississippi, following a termination of a two-year non-compete contract with Erco Worldwide to provide it with sodium chlorate. Tronox reported a long-lasting trend of a persistent decrease in the demand for paper products that use sodium chlorate; they actually wanted to opt-out from the sodium chlorate business several years earlier. However, Tronox always viewed its sodium chlorate production as a minor, subsidiary enterprise of manufacturing a few electrolytic products; Tronox is the world’s fourth-largest producer of titanium dioxide pigment.

On the contrary, Kemira Oyj, a global leader in the production and supply of chemicals for the pulp and paper industry and a major sodium chlorate producer, considers the prospects of the pulp and paper industry as bright, driven by global megatrends of urbanization, digitalization, and growing middle class. As such, to meet the growing demand for bleaching agents in the pulp and paper industry, Kemira has been actively expanding its sodium chlorate production capacities in different countries, including Brazil, Finland, and the USA. The most recent sodium chlorate production expansion by Kemira occurred at its manufacturing facility at Eastover, South Carolina in early 2020.

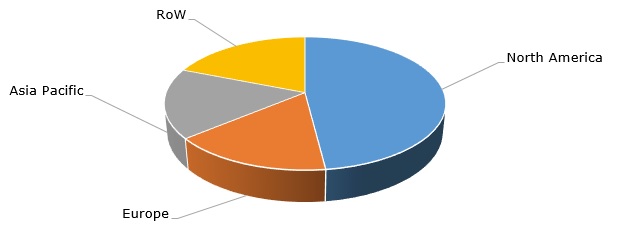

Structure of the global demand for sodium chlorate by region

Likewise, sodium chlorate constitutes one of the key commodities for companies like Erco Worldwide (Canada), Eka-Nouryon (former AkzoNobel Specialty Chemicals), or Chemtrade Logistics (Canada) [acquired Canexus Corporation in 2017]. Sodium chlorate is manufactured by their multiple production facilities worldwide to be consumed in different regions, where North America still plays a major, though gradually shrinking, role. These companies are committed to further develop the sodium chlorate market. Moreover, the performance of these companies in the current turbulent business environment, impacted by the global Covid-19 pandemic, confirms strong fundamentals of the sodium chlorate business. Most of the key sodium chlorate manufacturers exhibited rather good financial results during Q1-3 2020, though, of course, these companies are large diversified vertically integrated enterprises with extensive portfolios of products and multiple production facilities in different countries.

More cutting-edge information on the sodium chlorate market can be found in the in-demand research report “Sodium Chlorate: 2020 World Market Outlook and Forecast up to 2029”.