Hydrogen peroxide is an important commodity chemical used in various applications, among which the pulp and paper industry acts as the main outlet. With the spread of the COVID-19 pandemic, numerous agencies and media reported about the rising demand for hydrogen peroxide as a disinfectant, which is effective in sanitizing the environment. Hydrogen peroxide is widely employed as a popular, environmentally friendly, and a rather safe disinfectant for antiseptic treatment of inanimate surfaces. It is also used in oral or nasal sprays in order to reduce the progression of infection in treating some diseases. Some epidemiologists argue that this antiseptic capacity of hydrogen peroxide is useful in preventing the pandemic spread. However, other experts question hydrogen peroxide efficiency in preventing the coronavirus spread because of the lack of a mechanism, which allows hydrogen peroxide to attack or damage virus-protecting cell membranes and their proteins.

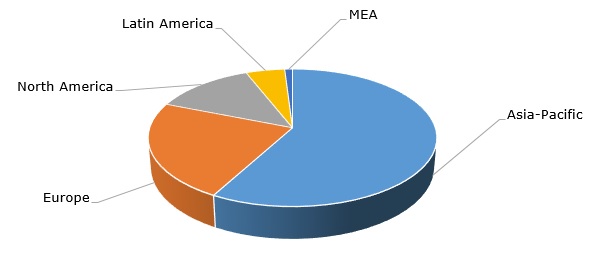

Despite these controversial findings, the rise in the demand for all types of disinfectants due to the pandemic was undisputed and unprecedented. There were numerous allegations that the transfer of the manufacturing facilities of multiple chemicals (e.g. disinfectants, active pharmaceutical ingredients, etc.) and materials (e.g. gloves) to Asia-Pacific, created a drastic vulnerability for the EU countries. It is a fact that, with respect to hydrogen peroxide production capacity, Asia Pacific holds the largest share. This outsourcing of production capacities to Asia-Pacific originated certain market imbalances. It turned out that the EU countries were unable to quickly supply sufficient volumes of vital chemicals and materials at the time of the pandemic. The repatriation of some of these businesses back to Europe might be desirable.

Structure of the global hydrogen peroxide production capacity by region

Both Solvay and Evonik, which are the two world’s largest manufactures of hydrogen peroxide, operate more than half of their production capacity outside the EU countries. However, their hydrogen peroxide production capacity in Europe is also substantial, and they continue to develop it. For instance, over the recent five years, Solvay has been adding new hydrogen peroxide capacity in Belgium, Finland, Germany, and the Netherlands. In parallel to this, the company boosts its hydrogen peroxide production capacity in Asia-Pacific. In mid-2020, Solvay launched a 24k mty hydrogen peroxide dilution and packing facility in Vietnam. This facility is supplied with hydrogen peroxide from Solvay’s plant in Thailand. Solvay is fully aware of the enormous potential of the Vietnamese market in consuming hydrogen peroxide, especially, for its booming textile industry. It is clear that Solvay will continue to expand its hydrogen peroxide business in Asia-Pacific thanks to the good prospects of this business in the region.

In a similar fashion, Evonik has been developing its hydrogen peroxide segment against the backdrop of the pandemic. Evonik has recently reported about the stable operation of its hydrogen peroxide segment and about the growing sales associated with it. In early 2020, Evonik completed a long-lasting acquisition of PeroxyChem, the US producer of hydrogen peroxide and peracetic acid. This acquisition solidified Evonik’s position as a top-tier producer of hydrogen peroxide. It was long overdue because of the legal action initiated by the Federal Trade Commission to block the purchase on the grounds that the merger would substantially reduce competition in several US regions. Before the acquisition, Evonik and PeroxyChem were two out of five existing manufacturers of hydrogen peroxide in the US.

Excellent prospects of the market for hydrogen peroxide are also recognised by another major producer, Mitsubishi Gas Chemical (MGC). The company is actively expanding its hydrogen peroxide production capacity and is developing the sector of super-pure hydrogen peroxide applicable for electronics and electrical applications (e.g. in etching, polymer removal, and resist stripping). It is known that this grade of hydrogen peroxide is more difficult to manufacture, and it is not identical to other types of hydrogen peroxide. In Taiwan, MGC plans to expand its hydrogen peroxide production capacity by building a 40k mty plant. MGC currently operates a 31k mty hydrogen peroxide facility there via its subsidiary MGC Pure Chemical Taiwan, Inc. In 2019, MGC (or MGC Pure Chemicals America, Inc.) has also doubled its existing 70k mty hydrogen peroxide production capacity in the US. The company launched two 35k mty plants in the City of Forest Grove, Oregon, and Killeen, Texas, respectively. These expansion plans confirm good prospects and evident resilience of the hydrogen peroxide market despite the ongoing uncertainty related to the pandemic.

More information on the global hydrogen peroxide market can be found in the in-demand research report “Hydrogen Peroxide (HP): 2021 World Market Outlook and Forecast up to 2030”.