The current situation on the global sulfuric acid market remains unstable, though there are some signs of optimism. It is clear that the Covid-19 pandemic had a very lasting and profound impact on the chemical and other industries. This impact reverberated along all production, supply, and consumption systems and chains, and it will not abate in the near future. However, the global sulfuric acid market has strong fundamentals, primarily in the form of agriculture and fertilizer sectors, which is instrumental in supporting the demand for sulfuric acid. For high-tonnage chemicals, like sulfuric acid, various macroeconomic factors play a significant role.

The start of 2021 has been rather positive for the sulfuric acid market in Asia-Pacific and South America, with rising demand, higher domestic buying interest, firmer prices, and stronger margins. The local markets began to experience a certain degree of tightness in the sulfuric acid supply. Naturally, these markets are driven by the availability of the huge agriculture sector with several cropping seasons.

The availability of sulfur, which is often dependent on the operational schedules of smelters and the metal market macroeconomics, is of key significance for sulfuric acid supply and prices. Some countries, like China, produce sulfuric acid mainly from burning sulfur rather than via smelter pathway. It is clear that with the increased Covid-19 uncertainty, the future scenarios of the sulfuric acid market behavior, affected by a wide range of varied forces, are hard to predict.

For instance, in early February 2021, the US Department of Commerce (DOC) finally took a decision to impose countervailing duties on US imports of Moroccan and Russian phosphate fertilizers. The duties are intended to combat government subsidies in Morocco and Russia that give their phosphate producers unfair cost advantages. The DOC calculated a rate of 19.97% for Moroccan producer OCP Group, as well as 9.19% and 47.05% for PhosAgro and EuroChem, respectively. Both PhosAgro and EuroChem are major manufacturers of sulfuric acid in the world. PhosAgro planned to boost its annual sulfuric acid production from 3.1 mln tons in 2018 to 4.4 mln tons in 2020. The move against the Moroccan imports was initiated to meet the request of OCP’s main competitor in the US, The Mosaic Company. The imposition of duties is still pending, subject to the decision by U.S. International Trade Commission (ITC), which runs a concurrent investigation. The world-be reduction in the Moroccan exports of phosphates to the US may influence OCP’s production of sulfuric acid and related products at Jorf Lasfar and Safi sites in Morocco. This country operates rather large sulfuric acid production capacities.

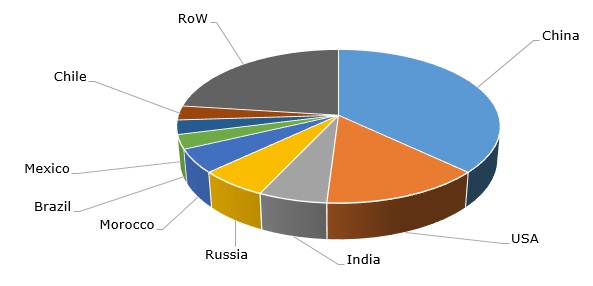

Structure of the global sulfuric acid production capacity by country

It is worthwhile to mention here that regulatory measures are paramount for the operation of the sulfuric acid market, which involves environmentally challenging production. Environmental regulations could be particularly demanding. Moreover, it now affects all regional markets, including China, where the introduction of a severe environmental tax in 2018 affected sulfuric acid production and prices.

The situation on the North American and European sulfuric acid markets is less certain, which is in line with macroeconomic growth expectations that are far from positive in these regions, judging by the slow roll-out of Covid-related vaccination and by drastic effects of the pandemic. Chemtrade Logistics (Canada), a major sulfuric acid manufacturer in North America, confirmed that the generally lower levels of economic activity resulted in reduced demand for merchant sulfuric acid in the region. Chemtrade recorded lower volumes of sales of sulfuric acid during the second half of 2020.

Bright spots may include a potentially strong demand for sulfuric acid from some sectors, like the production of semi-conductors, detergents, disinfectants, and some other chemicals. There are also expectations for firming of soybean and corn prices in the Americas, which might support higher soybean acreage in the 2021 planting season, while decent soil moisture levels in Australia may also induce larger use of fertilizers, positively affecting the demand for sulfuric acid in 2021.

More trustworthy information on the global sulfuric acid market can be found in the comprehensive research study “Sulfuric Acid: 2021 World Market Outlook and Forecast up to 2030”.