Phthalic anhydride is an important chemical intermediate, which is produced via the oxidation of o-xylene and naphthalene or mixed feed. Phthalic anhydride participates in the production of (saturated and unsaturated) polyester resins, polyols, plasticizers, alkyd resins, flame retardants, coatings, engineered plastics, insecticides and fungicides, pharmaceuticals, solvents, pigments, and a wide range of other chemicals, which are, in turn, can be used as intermediates. All these find application in various markets and industries.

Such functional versatility of phthalic anhydride dampened the negative effects of the Covid-19-driven macroeconomic crisis. In H2 2020, many regional phthalic anhydride markets experienced a reduction in production volumes and sales due to the drop in the demand for phthalic anhydride. For instance, Stepan Company recorded such a drop in the US market. Despite this, a steady recovery of the US economy is on the way, which invigorates the interest in phthalic anhydride in multiple sectors, including construction. This interest is also fuelled by the increase in the demand for timber as the US housing market and the global DIY markets show unprecedented growth. Strategically, Stepan recognises the high potential of the phthalic anhydride market as the company has recently acquired INVISTA’s aromatic polyester polyol business and associated assets, which further backs Stepan’s production of phthalic anhydride.

Another phthalic anhydride manufacturer in the US, Koppers Holdings Inc., also witnessed weaker demand for phthalic anhydride in the US due to a slowdown of markets during the pandemic in H2 2020. However, Koppers managed to offset this adverse impact thanks to its other activities (incl. on different markets), like production of carbon pitch in Europe and carbon black feedstock in Australia. Stepan, Koppers, and ExxonMobil are major phthalic anhydride producers in the USA. BASF ended phthalic anhydride production in the USA in 2015 (though it is engaged in phthalic anhydride catalysts business there) and retained phthalic anhydride production at its petrochemicals production hub in Ludwigshafen, Germany. Unlike BASF, ExxonMobil keeps its US-based phthalic anhydride production facility in Baton Rouge (Louisiana), and at the same time operates a European phthalic anhydride plant and a closely integrated plasticizer plant (both located in the Botlek area of the Netherlands). The latter plant is the largest producer of plasticizers in Europe.

In H2 2020, UPC Group (China), the world’s largest phthalic anhydride producer and one of the largest suppliers of plasticizers, phthalic anhydride, and maleic anhydride in the Far East area, confirmed a decline in phthalic anhydride sales in the Chinese and Taiwanese markets. Despite this, multiple players on the phthalic anhydride market from the Asia-Pacific region demonstrate optimism. Asia-Pacific remains key to the global phthalic anhydride market, and it currently shows a quick recovery during the ongoing pandemic.

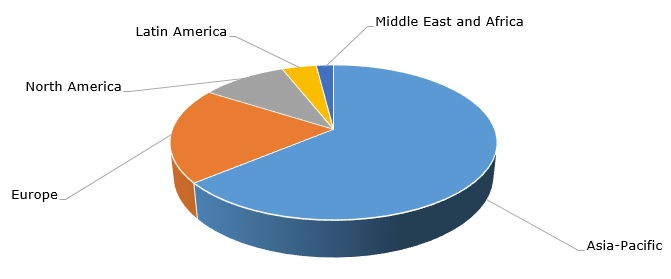

Structure of the global phthalic anhydride production capacity by region

Companies, like IG Petrochemical Ltd. (India) and KLJ Plasticizers, announced to set up new phthalic anhydride capacities in India. In parallel to these expansion plans, Indian phthalic anhydride/phthalate manufacturers (IG Petrochemicals, Thirumalai Chemicals, and the SI Group India Ltd.) filed an anti-dumping complaint against the imports of Japanese and Russian phthalic anhydride to this country. It seems that a five-year anti-dumping duty, which was in operation before and which expired in December 2020, will be imposed against Russian phthalic anhydride, while the imports of the product from Japan will not be affected this time. The final decision about these duties is still pending, as the Finance Ministry of India will provide notification in a couple of months.

A detailed analysis of the global phthalic anhydride market can be found in the in-demand research report “Phthalic Anhydride (PA): 2021 World Market Outlook and Forecast up to 2030”.