Acrylonitrile is an important commodity chemical with multiple uses and advantageous properties, like enhanced elasticity or good compatibility within polymer blends. As a monomer, it is primarily used in the production of acrylic and modacrylic fibers. This application segment accounts for over 50% of total acrylonitrile consumption. Its co-monomer is employed to make acrylonitrile, butadiene, styrene (ABS), and styrene-acrylonitrile (SAN) polymers (over 30% of total use). It is also an intermediate product to manufacture other chemicals, like adiponitrile and acrylamide. All these applications are associated with various industries and end products (incl. of essential significance in the current Covid-19 environment), like clothing, carpeting, textiles, automotive components, electronics, toys, medical gloves, personal care products, aeronautics, engineering, industrial rubber products (e.g. hoses, O-rings, linings, gaskets, and seals), to name only a few.

The global acrylonitrile market has always demonstrated quite a significant level of resilience despite the years of overproduction, economic crises, and other adverse factors. The fundamentals of this market have been strong, buoyed by growing demand for acrylonitrile and its products, like ABS polymers, carbon fiber, and composite materials, due to their superior attributes and driven by a sheer growth in GDPs worldwide. INEOS (UK), as one of the stalwarts of this resilience and a major acrylonitrile manufacturer, recognizes the acrylonitrile market potential. For instance, its decision to build a new state-of-the-art 425,000-tonne acrylonitrile plant in Saudi Arabia (in cooperation with Saudi Aramco and Total), scheduled to come on-stream in 2025, is a clear manifestation of understanding the acrylonitrile market prospects. INEOS is also a major developer of proprietary acrylonitrile-related technologies. This attribute greatly acts to the company’s competitive advantage in the acrylonitrile market. However, unauthorised copying could violate this advantage. This occurred several years ago when INEOS announced legal action against Sinopec and its subsidiaries for the breach of intellectual property rights related to acrylonitrile business technologies (Sinopec is a major acrylonitrile manufacturer in China with several production plants there).

The current situation in the acrylonitrile market is characterised by tight supply and a sharp rise in prices. This tightness is directly caused by shutdowns, force majeure circumstances, and maintenances at various acrylonitrile- and its feedstock-producing facilities worldwide (for various reasons). The supply deficit is also driven by quick recoveries of different markets, though the situation remains fully unclear and unstable, as Covid-19-related pandemic scenarios are very unpredictable. The current acrylonitrile prices are in sharp contrast with those in H2 2020 when they globally plummeted to record lows. The operation of US acrylonitrile plants is significantly affected by the spell of inclement weather conditions in Texas, US. The plant operated by Ascend Performance Materials at the Chocolate Bayou site (Alvin, Texas) experienced a power outage. INEOS’s facility in Green Lake is in shutdown (its plant in Lima, Ohio is operable).

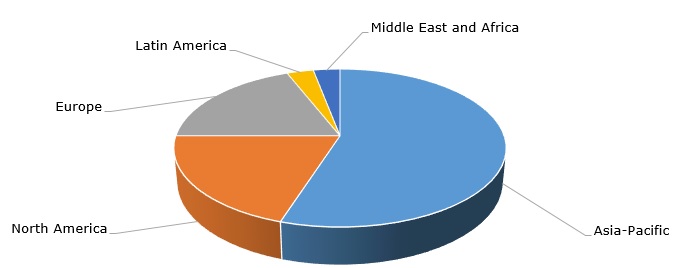

Structure of the global acrylonitrile production capacity by region

The European acrylonitrile market demonstrates similar dynamics with tight supplies and various manufacturing issues of key producers in the region. This pertains to the performance of INEOS (UK), Petkim Petrokimya Holding AS (Turkey), Lukoil (Russia), and Polymir (Belarus). These manufacturing issues reverberate across all production and supply chains, both downstream and upstream. However, the European market for various chemicals is also drastically influenced by Covid-19-related decrease in demand in its multiple end-use industries, like the automotive industry. As such, the tight supply with acrylonitrile can be coupled with the demand downturn in the consuming sectors. This could cause some producers of ABS plastics to reduce capacity utilization rates. At the same time, the Asian acrylonitrile market behaves in a more stable manner. The acrylonitrile production by Sinopec and Shanghai SECCO Petrochemical Company Limited is steady and gaining momentum after the start of a new lunar year. However, pandemic concerns on the Asian markets retain, which affects demand in various acrylonitrile-consuming sectors, like fibers.

An in-depth analysis of the global acrylonitrile market is provided in the comprehensive research study “Acrylonitrile (ACN): 2021 World Market Outlook and Forecast up to 2030”.