Maleic anhydride is an important chemical intermediate with extremely wide functionality. A specific structure of the chemical optimises its applicability in chemical conversions and transformations. Its key application areas include the production of unsaturated polyester resins (a major outlet that is associated with the production of versatile composites for multiple industries) and 1,4-butanediol or BDO (the second-largest outlet). The range of industries and end-products, which consume maleic anhydride, is very diverse. The onset of the Covid-19 pandemic made some of these products indispensable. Such essential products comprise pharmaceuticals, agricultural chemicals, food ingredients, water treatment substances, various plasticizers, and polymers. Other industries, like automotive, transportation, hospitality, etc., were adversely impacted. However, the level of this impact varies by region and is in a state of constant flux. For instance, the US and Chinese automotive industries in Q4 2020 and Q1 2021 bounced back, though the recovery to pre-Covid levels will take longer.

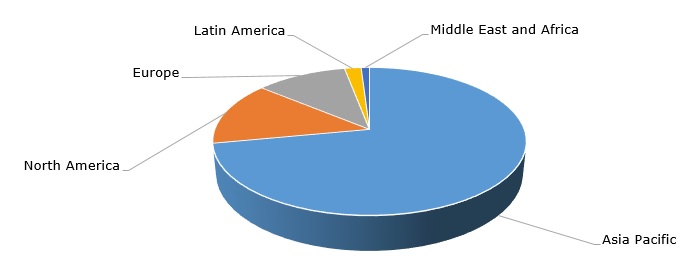

Maleic anhydride: structure of the global production capacity by region

The current demand for maleic anhydride is on the rise in different regions, which is driven by the reinvigoration of the national economies and an ensuing increase in chemical consumption, primarily in the US and China. This results in tighter supplies and higher maleic anhydride prices. The dynamic is paralleled by rising feedstock prices. Maleic anhydride uses benzene or butane as a feedstock, both derived from oil. The 1990ies gave the start to the conversion from benzene-based fixed bed technology to butane-based fluidized bed technology. Huntsman (the US), a major global producer of maleic anhydride, is also a key developer of maleic anhydride butane-based manufacturing technology, which remains among the most advanced in the world. Huntsman licenses this technology to China, Germany, Korea, Malaysia, Saudi Arabia, and Taiwan.

The prices at the maleic anhydride downstream market (e.g. BDO) also demonstrate an upward trend. In the USA, the chemical hubs in Texas, including the production of maleic anhydride (e.g. Lanxess Corp.’s facility in Baytown, TX) and BDO (e.g. LyondellBasell’s facility in Channelview, TX), were hit by the winter storm that idled most of the chemical production in the US Gulf. At the same time, the European and Asian Pacific maleic anhydride markets are currently experiencing manufacturing issues, tight supplies, and rising prices.

In general, the maleic anhydride market is viewed as prospective, though reduced margins and the need to effectively implement product integration strategies might cause chemical companies to opt-out from the maleic anhydride business. The latter was stressed when Ashland (US) sold its 45,000 mty maleic anhydride production facility at Neal, West Virginia to AOC Materials (US) in 2020. Ashland’s decision was dictated by a desire to streamline its product portfolio, concentrate on more specialty chemicals and escape narrow margins. However, such decisions may come at a cost, when divestment of maleic anhydride business can lead to maleic anhydride supply issues. Therefore, the opposite decisions associated with expansion plans are also common, easily confirming the attractiveness of the maleic anhydride business. One can mention here the plan by Polynt-Reichhold Group (composed of Polynt, Italy, and Reichhold, the US) to build a 50,000 mt/y maleic anhydride plant in Morris, Illinois, the US (the plant may come on-stream in late 2022). The operation at the Morris site will reflect an integrated business model, which tightly couples the production of maleic anhydride and unsaturated polyester resins. Effective integration of intermediates and resins is a healthy approach for the maleic anhydride market. Another example was evident when Huntsman acquired a remaining 50% share of its JV with Sasol (South Africa), which manufactures maleic anhydride in Moers (Germany). The deal was finalised in late 2019. These examples confirm both the promising and challenging character of the maleic anhydride market.

More information on the global maleic anhydride market can be found in the in-demand research study “Maleic Anhydride (MA): 2021 World Market Outlook and Forecast up to 2030”.