Formaldehyde (or aqueous formaldehyde solutions) is an important and versatile chemical with a major outlet in the production of formaldehyde-based amino, phenolic, and polyacetal resins. It is also used to manufacture various chemicals (e.g. BDO, MDI, and pentaerythritol), drying agents, textile-treating substances, lubricants, nitrogen fertilisers, gasoline stabilizers, preservatives in cosmetics, etc. Public health concerns are among key constraints for the global formaldehyde market development. These concerns arise from carcinogenic hazards associated with formaldehyde, though such hazards should be carefully scrutinised subject to formaldehyde exposure levels and application conditions, like product quality, environment, and usage culture.

The global crisis related to the COVID-19 pandemic has been detrimental for the formaldehyde market, which was affected by demand softness within multiple commodity chains. The formaldehyde market has just recently started a slow recovery after a tangible drop in H1 2020, though the rate of this recovery varies by region and industry.

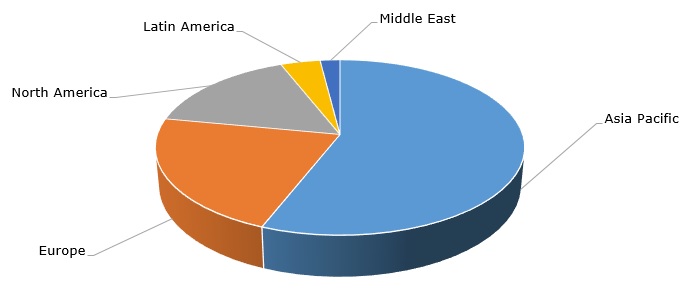

Formaldehyde: structure of the global production capacity by region

For example, the ongoing recovery of the US formaldehyde market is supported by the robust growth of the construction industry, which is a major formaldehyde-consuming sector, especially in wood-bonding applications. This occurs despite the complex Covid-19 situation in the country. With rising methanol costs, formaldehyde prices demonstrate an upward trend.

Celanese, one of the world’s leading manufacturers of formaldehyde and formaldehyde-based intermediates, is confident about the steady market restoration in 2021 and about the company’s capacity to combat the negative consequences of the crisis. Celanese operates formaldehyde production facilities in Canada, Germany, and the US. Its US facility in Bishop (Texas) was affected by the recent winter storm. In general, Texas hosts the largest number of formaldehyde plants in the US. Apart from Celanese, formaldehyde production facilities in Texas are operated by such companies as Hexion Inc. (formerly Borden Chemical), DB Western Inc., Georgia-Pacific Corp., and Eastman.

Hexion, a global leader in thermoset resins, shares similar optimism about the formaldehyde market prospects. Despite negative Covid-19’s impact, the company’s formaldehyde business in different countries showed steady growth already in Q4 2020 to continue in 2021. Ercros S.A. Group (Spain) exhibited analogous results. In 2019, the Group signed a new long-term formaldehyde supply agreement with its main customer for the 2021-2030 period, which establishes a strong foundation for its formaldehyde business.

China, the largest formaldehyde manufacturer, is currently experiencing rising demand and increased prices for formaldehyde after a significant drop in H1 2020. Chinese formaldehyde production is concentrated mainly in the south-eastern and eastern coastal provinces, with Shandong province hosting the largest number of formaldehyde-producing facilities in the country.

A detailed analysis of the global formaldehyde market can be found in the in-demand research report “Formaldehyde: 2021 World Market Outlook and Forecast up to 2030”.