Butadiene rubbers belong to an extensive family of elastomers and are noted for their excellent performance with respect to elasticity, abrasion resistance, glass transition temperature, and low-temperature flexibility. Apart from butadiene rubbers, elastomers comprise such versatile products as styrene-butadiene rubber, natural rubber, acrylonitrile-butadiene-styrene rubber, ethylene-propylene-diene-monomer rubber, to name only a few. Elastomers are manufactured by a broad range of manufacturers, like ARLANXEO, BASF, Dow, DuPont, Exxon Chemicals, Kumho Petrochemical, Lanxess, SINOPEC, Synthos SA, etc.

The production of automotive tires is a major outlet for butadiene rubbers. Other applications include electronics, technical rubber goods, footwear, non-tire automotive components, sports accessories, etc. Like other elastomers, butadiene rubbers represent a diverse family of products under various brands (e.g. Buna brand of butadiene rubbers produced by ARLANXEO), which are customised to originate specific grades, subject to specific needs and requirements. Butadiene rubbers are often used as blends with natural rubber and styrene-butadiene rubber.

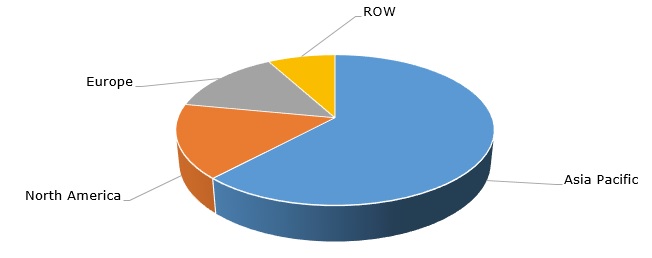

The current situation on the butadiene market, (which has been highly volatile for many years), remains uncertain, with a significant level of dynamism, though market fundamentals are robust. For instance, H1 2021 saw a quick recovery in China following the outbreak of the COVID-19 pandemic. Demand for butadiene rubber is driven by the rising downstream markets, including the automotive industry (especially in tire applications), construction, and electronics. The near-future scenarios of the Chinese butadiene market will depend on the consistency of the market recovery. An important driver is a rate of adding new production capacity in China in 2021. If strong demand and limited supply persevere further in 2021, as it was evident in H1 2021, the butadiene rubber market is likely to tighten significantly with prices demonstrating a clear upward trend. The dynamics of the Indian butadiene market are heavily affected by the so-called second wave of the pandemic and will be predicated on the ability of national and regional authorities to control the situation as some Indian states remain in a lockdown, while others perform relatively better. It is vital to mention that Asia is and will remain a key region with respect to butadiene rubber consumption and production.

Butadiene rubbers: structure of the global consumption by region

Meanwhile, the US market also encounters butadiene supply limitations, which were driven by a combination of factors, including the pandemic, production disruptions caused by the inclement weather conditions in the US chemical hubs, and a series of facility maintenance activities. These factors continue to push prices for butadiene, its feedstock, derivatives, and end-products further up. The current uncertainties make various manufacturers behave cautiously (or vice versa in a more risky manner), whereas the inertia of previous reductions in capacity utilization rates does not allow faster recovery in industrial production.

The situation in Europe remains somewhat similar with numerous facility outages and large supply constraints, though the general level of demand in various consuming sectors in Europe remains more subdued as compared to China and the US, though it is also rising. These challenges clearly signify the fragility of the elastomer market, which, despite strong fundamentals, could be easily unbalanced.

More information on the global butadiene rubbers market can be found in the in-demand research study “Butadiene Rubbers: 2021 Global Industry Overview and Forecast”.