Ethylene glycols (mono-, di-, tri- and poly-glycols) are indispensable intermediates with vital applications like resins, deicing, and heat transfer fluids, fibres, packaging materials, paper, leather, latex paints, antifreeze solutions, explosives, dehydrating agents, industrial solvents, cosmetics, construction materials, electrical goods, and printing inks. Ethylene glycols are used to manufacture polyethylene terephthalate and polybutylene terephthalate, which may be characterised as the most important polymers of the polyester class. As many of these derivative markets (e.g. packaging) are currently on the rise due to seasonal and COVID-related factors, this provides a good opportunity for the monoethylene glycol (MEG) market to compete with rival products for margins. Feedstock ethylene could be diverted to various derivatives subject to margin attractiveness.

The current situation on the MEG market is rather unbalanced as the market is trying to find a new equilibrium amid existing uncertainty. Despite this uncertainty, primarily associated with the ongoing COVID-19 pandemic, reinvigoration of business activities and growing demand for multiple chemicals is evident worldwide, driving the MEG market. The year-on-year fluctuations of MEG prices are reflective of this process. For instance, Asian Contract Price (in USD/mt CFR main Asian ports) for monoethylene glycol announced by MEGlobal company was $590/mt in July-August 2020, which is in sharp contrast with the current US$830-840/mt for July-August 2021 (with a peak of US$930/mt in April 2021). The rise in demand for MEG is occurring against the background of tightened supply at various markets. The supply shortage was largely caused by the COVID-19 impact in 2020, when the MEG markets experienced a severe blow, while the inertia of this effect reverberated throughout H1 2021. The supply may improve when capacity utilization rates increase, spot cargo availability picks up, and planned seasonal maintenance activities are completed. New MEG production capacity additions may ease the situation with its supply. For instance, ExxonMobil/Sabic JV plans the launch a 550k mt/y MEG plant in Q4 2021. The plant will operate within their petrochemical complex, which is under construction near Corpus Christi, Texas. The complex will manufacture ethylene, ethylene oxide, monoethylene glycol, and linear low-density polyethylene.

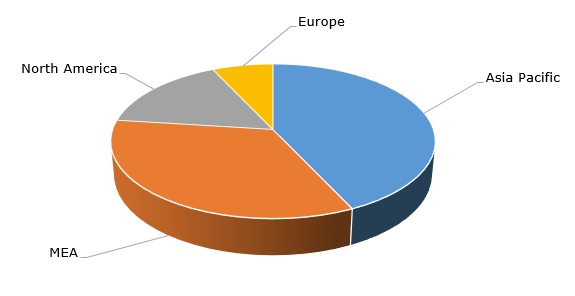

Monoethylene glycol: structure of the global production capacity by region

In May 2021, the European Commission made a decision to impose provisional anti-dumping duties (of various rates) against MEG imports to the EU. The duties are targeted at some US producers (e.g. Equistar Chemicals, ExxonMobil, Indorama Ventures Oxides, Lotte Chemical, MEGlobal Americas, and Sasol Chemical North America) and Saudi producers (e.g. Arabian Petrochemical Company, Jubail United Petrochemical Company, Petrokemya, Saudi Yanbu Petrochemical Company, etc.). This decision came unexpected and may exacerbate the overall MEG market uncertainty as it affects, directly and indirectly, all key MEG-producing regions. The situation with duties needs further clarification, but it may lead to the reorientation of some MEG trade routes, for instance, from the US to Asia, or from Asia to the EU.

More information on the global monoethylene glycol market can be found in the in-demand research report “Monoethylene Glycol (MEG): 2021 World Market Outlook and Forecast up to 2030”.