Polyarylsulfones or sulfone polymers, like polysulfone, polyphenylsulfone, polyethersulfone, and polyetherimide, belong to a class of heat-resistant high-performance amorphous specialty polymers. The product range of sulfone polymers is extremely diverse with hundreds of different formulations, which are used in vital applications areas, such as medicine, water purification/treatment (as membranes), personal care, household commodities, and the agro/food industry, as well as components for the electronic, automotive and aerospace industries.

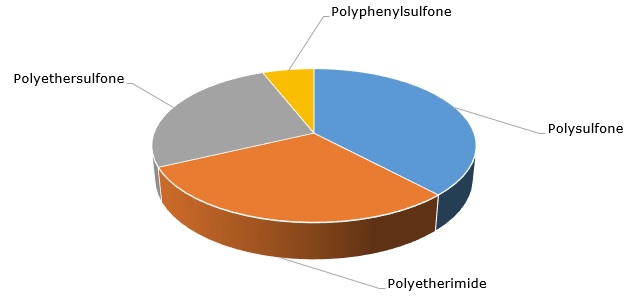

Market shares of high-performance amorphous polymers

There are several well-established trademarks of polyarylsulfones. Solvay, a world leader in high-performance specialty polymers, operates with the following trademarks: Udel for polysulfone, Radel for polyphenylsulfone, and Veradel for polyethersulfone. Ultrason is an umbrella trademark for BASF’s polyethersulfone (Ultrason E), polysulfone (Ultrason S), and polyphenylsulfone (Ultrason P). Westlake Plastics manufactures sulfone polymers under the Thermalux trademark.

Currently, the polyarylsulfone market is performing strongly due to robust fundamentals of the whole sector of specialty polymers. For instance, Solvay showed revenues of €2.6 billion in its Materials segment in 2020, which was an extremely challenging year for the global chemical industry. Solvay’s Materials segment comprises two business units: specialty polymers and composite materials. Together with sulfone polymers, Solvay’s portfolio of specialty polymers also includes such resin products as polyacrylamide, polyetheretherketone, and polyaryletherketone. Solvay achieved this revenue volume primarily owing to the excellent performance of its specialty polymers business unit as the composite materials unit was lagging behind throughout 2020. This trend continued in 2021. In Q1 2021, Solvay’s net sales in specialty polymers went up by 10% year on year. Solvay produces sulfone polymers at its facilities in Marietta (Ohio, US), Augusta (Georgia, the US), and Panoli (Gujarat, India). Their total polyarylsulfone production capacity is roughly 36,000 tonnes per year.

Likewise, in H1 2021, BASF’s financial results in the Materials segment were very promising. This segment consists of two divisions: Performance Materials and Monomers. The Performance Materials division features specialty polymers, including sulfone polymers manufactured under the Ultrason trademark. BASF produces Ultrason resins in Ludwigshafen (Germany) and Yeosu (Korea). The current Ultrason production capacity reaches 24,000 tonnes per year.

These examples from key manufacturers confirm the robust performance of the polyarylsulfone market. It is driven by the current resurgence of multiple derivative markets and strong fundamentals of the specialty polymer sector.

More information on the global polyarylsulfones market can be found in the comprehensive research study “Polyarylsulfones (PSU, PESU, PEI, PPSU) 2021 Global Market Review and Forecast to 2030”.