Polyvinylidene fluoride (PVDF) is a fluorine-containing polymer. It is manufactured by dehydrochlorination of 1,1,1-chlorodifluoroethane or by dechlorination of 1,2-dichloro-1,1-difluoroethane. KF (Kureha), Kynar (Arkema), Hylar, and Solef (both Solvay) are among the most famous PVDF tradenames.

Polyvinylidene fluoride is used in various applications, including coatings, chemical engineering, offshore oil extraction, water treatment, lithium-ion batteries, and photovoltaic panels. PVDF filaments can be used in 3D printing. For instance, filaments made from PVDF manufactured by Solvay are applicable for 3D printing, thus catering to complex industrial applications where conventional technologies such as injection molding fail. Fluoropolymers can be incorporated into the circular economy and sustainable development of the polymer industry, which was confirmed by a recent decision of Arkema to acquire Agiplast company, a leader in the regeneration of high-performance polymers, in particular specialty polyamides and fluoropolymers. Such functionality substantiates the innovative and sustainable character of PVDF material.

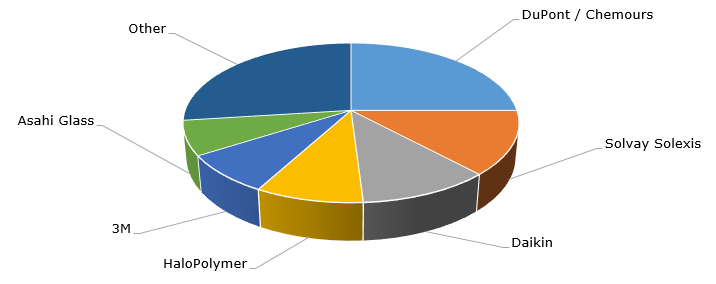

Leading fluoropolymer manufacturers

Leading fluoropolymer producers demonstrated strong performance in H1 2021 by showing significant growth in value and volume terms, driven by high demand in most end markets. This occurred despite a sharp rise in feedstock prices and manufacturing costs during this period. For instance, in Q2 2021, the revenues of the “Advanced Materials” division of Kureha Corporation, (PVDF production pertains to this division of this company), rose by 64.5% year on year. Solvay exhibited an analogous performance during Q2 2021. Sales in its “Specialty Polymers” division (it hosts PVDF production) increased by 16% compared to Q2 2020, and by 5% versus Q1 2021. The sales were boosted by strong demand for polymers in the automotive sector (esp. by demand for batteries used in hybrid and electric vehicles), electronics, and consumer goods.

The current strong performance of the polyvinylidene fluoride market may be confirmed by business development decisions made by key PVDF manufacturers. For example, in early 2021, Arkema announced a substantial investment to further increase its fluoropolymer production capacities in Changshu by 35% in 2022. The Changshu plant is Arkema’s third global integrated PVDF production plant with the first batch of Kynar PVDF produced in 2011. The company stressed that this decision was backed by excellent prospects of the PVDF market driven by such applications as lithium-ion battery business, water filtration, coatings, and the semiconductor industry. The huge potential of the Chinese market, which demonstrated great resilience in the face of the COVID-19 pandemic, was also an important factor.

More information on the polyvinylidene fluoride (PVDF) market can be found in the comprehensive research report “Polyvinylidene Fluoride (PVDF) 2021 Global Market Review and Forecast to 2030”.