Polybutylene terephthalate (PBT) is a polyester resin and a high-performance engineering plastic material with a wide range of applications, including the automotive sector, household appliances, packaging, electrical items, and electronics. PBT is manufactured by either polycondensation of terephthalic acid or transesterification of terephthalic acid dimethyl ester with 1.4-butandiol (BDO), though the main outlet of terephthalic acid is polyethylene terephthalate production. Key PBT tradenames include the following: Arnite T and Arnite Care (both DSM; Arnite Care is specifically used for medical applications), Crastin (DuPont), Duranex (Polyplastics), Enduran (SABIC), Pocan (Lanxess), Toraycon (Toray), Ultradur (BASF) and Vestodur (Evonik). Each tradename comprises a diverse assortment of grades, customisable subject to a specific application sector or customer needs. This customization may put stringent requirements for various product parameters, like purity, rigidity and strength, abrasion/heat/hydrolysis/chemical resistance, processing capacity, flame retardancy, and dimensional stability. The interest in PBT and other high-performance engineered polymers is also driven by tightening environmental regulations and safety standards, which stimulates innovations in this sector.

Since the global automotive industry remains the largest end-sector for PBT, the impact of this industry on the PBT market is essential. In 2021, the global automotive industry continued its path of recovery following a very complex pandemic-impacted year of 2020 as multiple countries are currently combating the consequences of this ongoing pandemic. However, the issues with the automotive market recovery are also vivid. For example, all major car manufacturers in Asia, Europe, and America have to cope with significant constraints related to semiconductor chip production and supplies. On the Asian-Pacific market (the largest PBT market), the chip shortage acted as one of the key factors, dampening demand for PBT and reducing its prices.

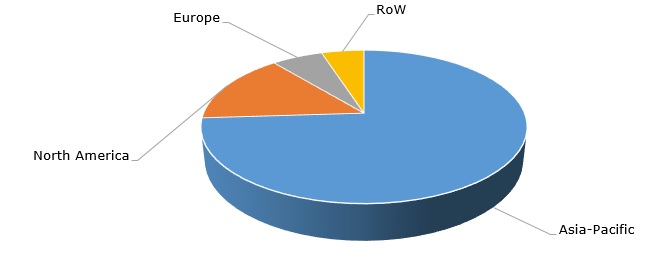

Structure of the global polybutylene terephthalate production capacity by region

In Europe, PBT prices demonstrated an upward trend thanks to tightening supply and rather strong demand across all PBT-consuming sectors. However, price increases for PBT were often ascribed to escalations in raw material (including BDO) and other costs. For instance, this was the case for DSM’s Arnite grade PBT, which experienced two global price increases in 2021, or all PBT DURANEX grades made by Polyplastics. The increase in Polyplastics PBT prices, effective February 2021, was also linked to rising feedstock and logistics costs.

Despite somewhat varied inter-regional dynamics of the PBT market, most PBT-producing companies, like BASF, DSM, Lanxess, or Evonik, demonstrated significant growth of sales in their multiple divisions, including in the segment of high-performance engineered polymers. The same refers to the current expectations for Q4 2021 and the next year, which promises a stable rise in earnings. All these companies mark a very positive pace of the engineered polymer market development driven by strong demand from the automotive industry, which benefitted the sector of engineering materials in particular.

Find more information on the global polybutylene terephthalate (PBT) market performance and trends in the in-demand research report “Polybutylene Terephthalate (PBT) 2021 Global Market Review and Forecast to 2030”.