Polyacetal or polyoxymethylene (POM) is an aliphatic polymer and a formaldehyde-based engineering thermoplastic. In line with other polymers, it is characterised by functional versatility, finding uses in construction materials, gearboxes, conveyor belts, valves, consumer electronic devices, garden equipment, footwear, nuclear engineering components, toys, ski bindings, watches, medical delivery devices, to name only a few. Advanced properties of POM, like dimensional/thermal/chemical stability and resistance to wear, cater for its wide applicability and could be adjusted thanks to polymer science developments in order to suit multiple industries and specialised applications. As a result, special material-producing companies are able to offer whole portfolios of polyacetal products.

Well-established polyacetal tradenames include Amcel, Celcon and Hostaform (all three by Celanese Corp.), Delrin and Delrin Renewable Attributed (both by DuPont; the latter of the two is based on renewable feedstock), DURACON (Polyplastics, now wholly owned by Daicel Group after Celanese sold its 45% stake in the company), Iupital (Mitsubishi), Tenac (Asahi) and Ultraform (BASF).

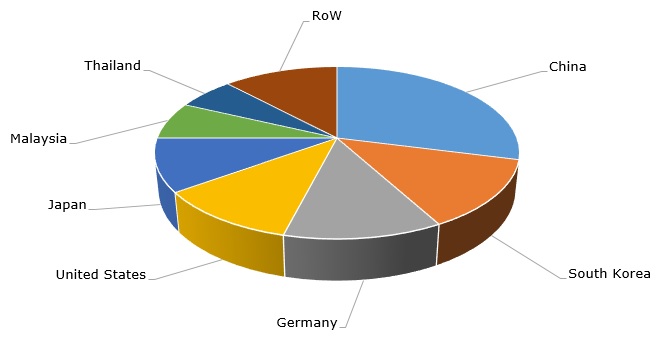

China accounts for the largest polyacetal production capacity, followed by South Korea, Germany, the US and Japan. The behaviour of the global polyacetal market looks largely fragmented by region, country and industrial sector.

Global polyacetal (POM) production capacity by country

The current state of the POM market is characterised by rising feedstock/manufacturing costs (this includes transportation, logistics, energy, and raw material costs) and strong demand for polyacetal products, which often led to the limited supply of POM (especially in Europe). The rise in manufacturing costs was also driven by unprecedented instability of the energy markets, like, for instance, energy supply shortages in China in October 2021. It is important to mention that polyacetal supply weakness was exacerbated by Covid-related lockdowns imposed in certain countries throughout the year. The increase in feedstock and manufacturing costs boosted the price for polyacetal products made by various manufacturers. For instance, in late October 2021, Celanese Corporation, a US-based global chemical and specialty materials company, had to augment the price of its POM globally. The surcharge on the POM price ranged from $0.30/kg to $0.50/kg subject to a specific region (the largest rise occurred in Europe, while the lowest one referred to the Americas). It was the second increase in POM price by Celanese since the start of the year (the first was by $0.20/kg in January 2021). Likewise, in April 2021, Polyplastics raised the price for its DURACON POM resins by $0.30/kg. The company made this decision to meet the rising demand for engineering thermoplastic resins and combat the drastic increase in raw material and logistical costs. In the same vein, in May 2021, DuPont increased prices for Delrin polyacetal polymers by US$250/mt (for Americas and Asia-Pacific) and EUR 210/mt (for EMEA). These dynamics confirm the current turbulent character of the POM market behaviour, triggered by the COVID-19 pandemic and its recuperation activities.

More information on the global polyacetal (polyoxymethylene, POM) market can be found in the comprehensive research report “Polyacetal (Polyoxymethylene, POM) 2021 World Market Outlook and Forecast to 2030”.