Propylene glycols (mono-, di-, tri-propylene glycols and higher glycols) represent a group of chemicals with a wide range of applications, including the production of unsaturated polyester resins, specialty plasticizers, cosmetics, and personal care products (e.g., scent carriers), laundry products, pharmaceuticals, foods, pet food, tobacco humectants, solvents, paints, coatings and various functional fluids (deicing/antifreeze, hydraulic, brake, heat transfer, and other fluids). Propylene glycol can absorb extra moisture, act as a solvent and be a relatively safe chemical. These features lay a strong commercial foundation for its use in the cosmetic, food, and pharmaceutical industries.

Traditionally, propylene glycols are sourced from petrochemical feedstock: they are manufactured by hydration of propylene oxide. However, propylene glycols can be also produced from renewables (e.g., glycerin). Such a “green” production pathway may significantly reduce greenhouse gas emissions (by up to 80%) when compared to standard propylene glycol. For instance, Archer Daniels Midland Company (ADM) employs the proprietary ADM Glycols technology, using a catalytic process known as hydrogenolysis to readily convert glycerin into propylene glycol. For bio-based propylene glycol producers, the year 2021 was not particularly successful. One of the key producers of this type of propylene glycol, Global Bio-Chem Technology Group Company Limited (China), had to cope with high prices for corn and a smaller yield of this agricultural crop in China in 2021. In general, the large imbalances of the agricultural market stimulated China to increase its strategic food reserves in 2021, which will roll over to 2022. Global Bio-Chem Technology Group uses corn as a raw material to produce propylene glycol. The rising corn prices decreased the company’s profit margins and revenues, causing it to suspend most of its production facilities during the first half of 2021. China remains the world’s second-largest manufacturer of propylene glycol.

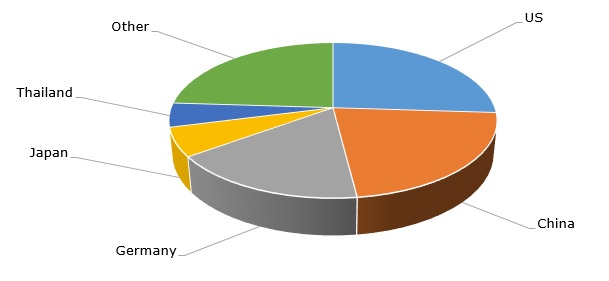

Propylene glycol: structure of the global production by country

The current unprecedented rise in upstream and downstream prices for multiple chemicals is often paralleled by supply shortages. Of course, demand for different chemicals varies subject to specific factors and regions. In relation to propylene glycols, the demand has also a vivid seasonal character, when, for instance, mild winters usually mean less demand for propylene glycols in deicing and antifreeze applications. The rise in propylene glycol prices was evident in late 2021. For example, in North America, Dow Chemical Company raised the prices for all its propylene glycol products by $0.07 per lb, effective early September 2021. The price increase was boosted by rising feedstock costs. In North America, strong demand among various sectors drove propylene prices. In Europe, the situation was somewhat similar as rising crude oil costs spread across all petrochemical product chains, including propylene glycol.

More information on the global propylene glycol market can be found in the insightful research study “Propylene Glycol (PG): 2021 World Market Outlook and Forecast up to 2030”.