Ethyl acetate (ETAC) is an important chemical product with broad applicability. It is manufactured via different production routes. Traditionally, it is obtained with the help of the esterification reaction between glacial acetic acid and industrial ethanol or ethylene. Alternatively, Sasol (South Africa) uses a process developed by Norwegian company Kværner ASA. Under this process, ethanol dehydrogenation results in ethyl acetate formation via acetaldehyde. Other production methods are known too.

Ethyl acetate is a building block of complex production chains and networks of feedstock materials, intermediates, and end-products. In this capacity, the ETAC market is driven by the dynamics of its upstream and downstream segments. For instance, Jiangsu Sopo (China), which is a key ETAC manufacturer with 400k mty capacity, can “skip” ETAC production and decide to sell acetic acid instead, when ETAC feedstock costs rise. In a similar vein, Korea Alcohol Industrial Co. can just idle ethyl acetate production when ETAC feedstock prices grow while demand lags behind. However, in Q4 2021 and early 2022, the global ethyl acetate market dynamics were different. ETAC prices steadily grew, driven by rising feedstock costs, limited supply, and strong demand from multiple ETAC-consuming sectors. Regional dynamics were more complex and varied as different factors intervened, like turnarounds at major ETAC-manufacturing facilities, force majeure circumstances (e.g. 2021 Hurricane Ida in the US or the energy crisis in China), rise in transportation tariffs, and so on.

Despite the ongoing fluctuations, the ethyl acetate market has a solid foundation. ETAC is used in a variety of applications in different commodity groups and industries, including the production of coatings, paints, inks, adhesives, solvents, synthetic resins, cosmetics, and other products. Therefore, acetyls business is strongly embedded in and associated with multiple industries, like furniture production, agriculture, construction, car manufacturing, architecture, pharmaceutical and cosmetic industries, food industry, marine applications, to name only a few.

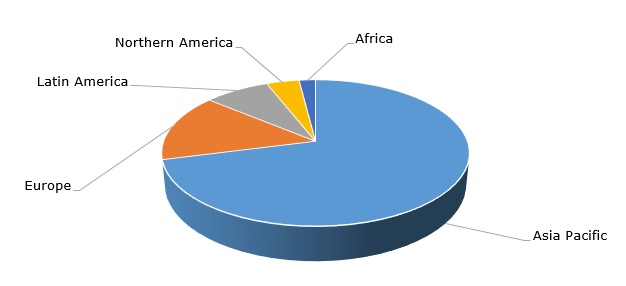

Ethyl acetate: structure of the global production capacity by region

As with multiple volatile organic compounds, environmental and safety constraints loom large in the coating applications. These constraints pose tangible risks for the segment of ethyl acetate coatings as preference could be given to waterborne and high-solids coatings, as well as powder and two-component coating systems. However, these concerns could hardly prevent the ETAC market from further development. Recognizing good prospects of the ETAC market, in 2021 Ineos (UK) acquired acetyls business from BP, further consolidating its position on the petrochemicals market. The acquisition was dubbed “a lockdown deal”: it was executed virtually by Skype during the COVID-19 restrictions. In 2008, Ineos acquired BP’s ethyl acetate business in Hull (UK). Ineos currently operates the largest ethyl acetate unit in Europe, which is the world’s second-largest producer of ethyl acetate. These facts confirm that despite multiple challenges, prospects for the global ethyl acetate market remain optimistic.

More cutting-edge information on the global ethyl acetate market can be found in the insightful research study “Ethyl Acetate (ETAC): 2022 World Market Outlook and Forecast up to 2031”.