Formaldehyde is a versatile chemical product and a common precursor, produced via a series of technological processes, involving the oxidation of methanol with the help of catalysts. Traditionally, formaldehyde is manufactured and sold as formalin (37% formalin), which is an aqueous solution of formaldehyde with methanol. Formaldehyde reacts with other chemicals, like urea, phenol, and melamine, to form corresponding resins. In turn, urea, phenolic and melamine resins are industrial polymers, which could be cross-linked and customised for a myriad of specific applications to comprise vast portfolios of end-products. Formaldehyde is used in construction, furniture, textiles, paints, adhesives, lubricants, nitrogen fertilisers, gasoline stabilizers, filtration, to name only a few. The markets for many of these products are currently on the rise, which promises strong demand for formaldehyde solutions in the nearest future. Contract methanol prices show an upward trend in Asia-Pacific, Europe, and North America in Q1 2022 (these three regions are major formaldehyde manufacturers. The upward methanol price trajectory is likely to remain against the background of skyrocketing gas prices and will continue to push formaldehyde prices up.

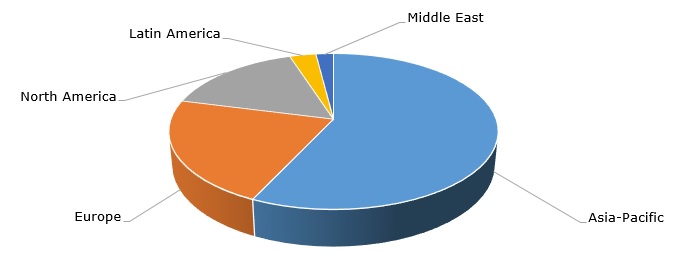

Formaldehyde: structure of the global production capacity by region

The use of formaldehyde has been already banned by the EU in such an important application as a pathogen killer in animal feed since formaldehyde was classified as a carcinogen, a mutagen, and a skin sensitizer. Since then, many companies have been trying to develop new solutions to protect food safety without using formaldehyde. This problem has been addressed by Perstorp (Sweden), which is a major manufacturer of formaldehyde products. In general, formaldehyde application is strictly controlled. The most recent EU regulation relates to the labeling of cosmetic products that contain formaldehyde releasers. The regulation decreases the formaldehyde release threshold in the finished products to just 0,001 % (10 ppm), and if this threshold is exceeded, the product should be labeled accordingly. This measure is likely to be adopted in Q2 2022.

It is worthwhile to mention that reducing the formaldehyde release into the environment is not a prerogative of the national governments. Nowadays, companies with a strong focus on sustainability are keen to do their best to deal with this issue. For instance, Georgia-Pacific Chemicals (the U.S.), which is a major manufacturer of formaldehyde, has been developing a new technology to reduce free formaldehyde in phenolic fibre-reinforced polymer resins to less than 0.1%.

These facts confirm that the situation with various formaldehyde-consuming products is very dynamic and constantly evolving. Since formaldehyde may pose tangible risks for humans and the environment, the companies operating on this market should fully comply with imposed regulations, as well as engage in developing innovative products which could help mitigate these risks.

More reliable information on the global formaldehyde market can be found in the comprehensive research report “Formaldehyde: 2022 World Market Outlook and Forecast up to 2031”.