Potassium hydroxide (caustic potash or KOH) is a versatile and popular chemical commodity deeply embedded in the chlor-alkali industry and used in a wide range of applications. It serves as a component in the production of liquid fertilizers, batteries, biodiesel, soaps, detergents, fabric, paints, glass, ceramics, and precursors for many chemicals, like potassium carbonate and potassium phosphates. The latter act as versatile commodities themselves, so potassium hydroxide is involved in long chains and networks of raw materials, intermediates, and end-products. Other applications include the use in medical and biological tests, food production, and others. Such versatility is governed by potassium hydroxide properties like its hygroscopicity and high reactivity towards acids.

Key areas of potassium hydroxide consumption feature such strategic sectors as agriculture, foods, pharmaceuticals, and petrochemicals, which are currently on the rise. This circumstance determines the current “bullish” dynamic of the KOH market, which is characterised by strong demand due to the ongoing reinvigoration of these sectors. Against this background, in Q3-4 2021, major potassium hydroxide manufacturers, like UNID Co. (South Korea) and OxyChem (the U.S.), demonstrated increases in sales volumes and revenues, including in their chlor-alkali businesses. The general forecast for the whole chlor-alkali industry is very positive as the demand for chlor-alkali products will grow and this market is expected to register a CAGR of 5.4% between 2021 and 2031.

Commercial manufacturing of potassium hydroxide involves the electrolysis of an aqueous solution of potassium chloride or potassium carbonate by using a predominantly membrane cell method as other methods lack environmental friendliness or economic viability. Mercury-based chlor-alkali production technology, which is considered dangerous, has been already phased out in the EU (Europe as a region has the second-largest potassium hydroxide production capacity). For instance, Altair Chimica (Esseco Group, Italy) has been the first European potassium hydroxide producer to fully convert to mercury-free membrane cell technology. When Altair Chimica unveiled its new 80k mty potassium hydroxide plant in Pieve Vergonte (Italy) in 2021, the company also remediated the old mercury plant, with disposal of all pollutants present on site. Likewise, mercury-free membrane cell technology is employed by OxyChem (the U.S.), Vynova/International Chemical Investors Group (Belgium/Luxembourg), INOVYN/INEOS (the UK), Taurus Potash Company (China), and other major KOH producers.

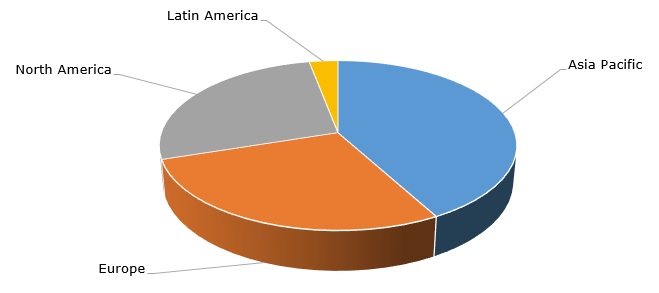

Potassium hydroxide: structure of the global production capacity by region

In general, ecological considerations are starting to play an important role in the whole chemical industry. For instance, the US Senate has recently supported a new bill within the so-called superfund used for remediation activities to combat environmental pollution from chemicals. This measure will raise a tax per tonne of potassium hydroxide from $0.22 to $0.44. This does not seem like a big figure, but still, the trend associated with further regulatory scrutinization of chemical production practices is vivid.

More cutting-edge information on the global potassium hydroxide market can be found in the in-demand research report “Potassium Hydroxide: 2022 World Market Outlook and Forecast up to 2031”.