Titanium dioxide (TiO2) is an industrial mineral commodity with multiple applications (especially as a colouring pigment) in cosmetics, the food industry, healthcare, paints, coatings (in cars, boats, construction materials etc.), paper, plastics, disinfectants, antimicrobials and other applications. Titanium dioxide is extracted from the ore of some naturally occurring minerals (e.g., anatase, brookite, ilmenite or rutile) and then generally marketed as an amorphous powder. Among its various production methods, chloride-based technology is considered to be superior as compared to older sulphate technology, known for large amounts of waste materials, expensive pollution controls and other disadvantages.

The broad applicability of titanium dioxide hinges on its unique properties, like superior whiteness, excellent refractive ability, chemical inertness, increased durability (when used in coatings), self-cleaning properties (incl. for sterilization, sanitation and remediation), potential for organic matter decomposition, capacity to block the absorption of ultraviolet rays and relative safety to be used in food, medicinal and cosmetic applications. However, the safety of using titanium dioxide in the latter applications has been recently questioned by the European Food Safety Authority, and, according to the European Commission, titanium dioxide as an E171 food additive will be banned in the food industry as of summer 2022 after a six-month phase-out period. France banned titanium dioxide earlier, in 2020.

The current state of the titanium dioxide market is characterised by strong demand across various consumption sectors and rising TiO2 prices, paralleled by limited availability of titanium dioxide feedstock. This shortage was originated owing to multiple factors. Among such factors, one can indicate force majeure circumstances at some TiO2-producting mines, as well as the disruption of the supply chains and logistics caused by the Covid-19 pandemic. However, the key companies on the titanium dioxide market demonstrated a very strong performance in Q4 and throughout the whole 2021, despite the existing uncertainties. For example, in 2021, titanium dioxide producer Tronox (the U.S.) increased its revenue by 30% y-o-y. Likewise, in 2021, Chemours (the U.S.) showed a robust 40% sales growth y-o-y in the titanium segment. Moreover, this sales growth was evident across various regional markets on which Chemours operated.

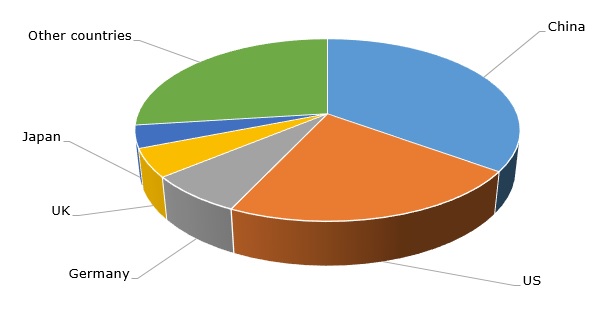

Top titanium dioxide-manufacturing countries

Both Tronox and Chemours plan tangible production capacity additions in 2022, which confirms good prospects for the TiO2 market and may, at least, partially alleviate the issues with titanium dioxide supplies. After acquiring Cristal Global in 2017, Tronox now operates over 1.3 mln of TiO2 production capacity, becoming the global market leader. In the same vein, Venator (the UK) showed a strong performance of its titanium dioxide segment in 2021.

However, the big challenge to this growth may be posed by the significant rise in raw material, shipping and energy costs, which boosts national inflation rates in different countries and can undermine the process of the economic revival. The situation can be further exacerbated by the current political unrest in Eastern Europe.

More information on the global titanium dioxide market can be found in the insightful research study “Titanium Dioxide: 2022 World Market Outlook and Forecast up to 2031”.