Epichlorohydrin (ECH) is a vital chemical intermediate which is indispensable in the production of epoxy resins. The latter are in turn important in the production of anti-corrosive coatings for multiple industries. Epichlorohydrin is also used to manufacture textiles, paper, inks, dyes, ion exchange resins, surface-active agents, rubbers, plasticizers, agricultural biologically active compounds, flame retardants, to name only a few. ECH is usually manufactured by adding hypochlorous acid to allyl chloride, derived from propylene by chlorination. Epichlorohydrin is further converted to bisphenol A, which acts as a raw material for epoxy resins and elastomers.

Epichlorohydrin production from renewable feedstock glycerol (often abbreviated as ECH-G) instead of the propylene route is also common and has been gaining momentum. For instance, in Europe, Spolchemie Group (Czech Republic) was the first company, which started to produce ECH from glycerol in 2007, thus limiting carbon footprint and earning a reputation of a company which genuinely cares about sustainability. The world’s largest glycerol-based epichlorohydrin production complex (capacity: 150k mty) will be constructed by Haiwan Chemical in Qingdao, Shandong province, China. This “green” route of ECH production is of key significance in the current environment when Chinese authorities have recently started to shut down epichlorohydrin-manufacturing facilities unable to meet ecological regulations (China is the world’s largest manufacturer of epichlorohydrin). Likewise, Hexion (the U.S.) plans to add 25k mty ECH-G production capacity at its plant in Pernis (the Netherlands) by 2024.

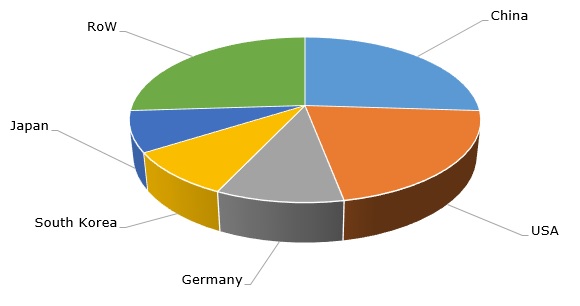

Epichlorohydrin: structure of the global production by country

Currently, the multiple industries have been adversely affected by the perfect storm of the coronavirus pandemic and global political instability, and the epichlorohydrin market is not an exclusion. As the prices for energy, petrochemicals and various commodities skyrocketed and the global logistics crisis started to fully unfold in 2022, slowing down the economic recovery, the demand for epichlorohydrin could not catch up with the increase in its production costs. In parallel, there is also a limited availability of epichlorohydrin on the market. All ECH producers experienced significant inflation rates and supply-side constraints in both raw materials and logistics, which led to ECH price increase, thus further pushing up inflation and limiting demand. This trend has had a ripple effect along the whole production chain. For instance, some consumers of epoxy resins have to reduce the capacity utilization rates as they are not certain if the demand for their end-products would be sufficient enough to generate acceptable margins amid rising expenses. In order to address these challenges, some companies, like Osaka Soda (Japan), implemented urgent resilience plans, improved corporate management practices and established a stable supply system. This paid back for Osaka Soda, since all its incomes during the nine months ended December 31, 2021 reached record highs.

More information on the global epichlorohydrin market can be found in the comprehensive research report “Epichlorohydrin (ECH): 2022 World Market Outlook and Forecast up to 2031”.