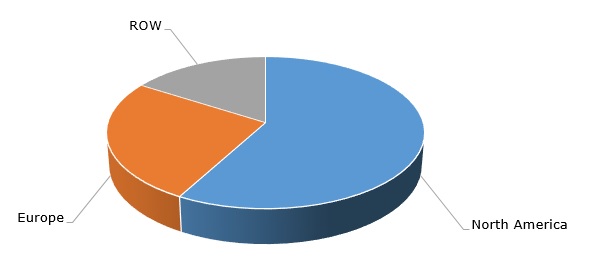

Hydrogen cyanide (HCN) is a chemical intermediate which is used to manufacture a wide range of products. For instance, hydrogen cyanide directly reacts with sodium hydroxide solution to produce sodium cyanide, which is in turn employed to extract gold, silver and other precious metals in mining. As an intermediate, hydrogen cyanide is involved in complex commodity-manufacturing chains composed of other intermediates and end-products. Hydrogen cyanide itself involves various manufacturing pathways, including as a by-product of acrylonitrile production. With almost 3 million tonnes in production, the global market for hydrogen cyanide is dominated by North America and Europe.

Hydrogen cyanide: structure of the global production capacity by region

Most hydrogen cyanide-manufacturing companies, such as Ascend Performance Materials and Invista, operate as vertically integrated manufacturers with broad portfolios of ingredients, intermediates and end-products (e.g., Performance Materials is the world’s largest fully integrated producer of polyamide 66 resin). However, some producers in the cyanide segment act in a more specialised manner. For instance, Draslovka Holding (Czechia) is a global leader in cyanide-based chemical specialties, though over the recent years the company has diversified by expanding its product range and geographic coverage. In 2021, Draslovka acquired the mining solutions business from The Chemours Company, that operated the world’s largest solid sodium cyanide plant in Memphis (Tennessee). Thus, Draslovka became the world’s largest producer of solid sodium cyanide and hydrogen cyanide-based specialty chemical products.

Since hydrogen cyanide gas is a highly toxic chemical asphyxiant that could block the body’s ability to use oxygen, the international trade with hydrogen cyanide is practically non-existent, while safety and environmental concerns related to its production and handling are paramount. Moreover, in case of its use in mining operations, cyanide production should be relatively close from mining sites. To this extent, Cyanco (the U.S.), the global leader in mineral extraction chemicals, manufactures sodium cyanide in Nevada, which is considered America’s gold-producing hub. In addition, the company operates distribution centres in Canada and Mexico, as well as in Africa and South America.

An intermediate status of hydrogen cyanide makes the hydrogen cyanide market fully susceptible to behaviours of various end-product markets. Among these markets, one can single out those for nylon polymer products, plastics, coatings, adhesives, fire retardants, cosmetics, pharmaceuticals, food products, and precious metals. Practically all these markets are highly prospective both globally and regionally. For example, the growing nylon 6,6 polymer demand in China and the Asia-Pacific region will remain a steady trend in the coming 2-3 years. This trend is evident for Invista, which plans to double its current nylon 6,6 polymer production at Shanghai Chemical Industry Park by 2024 and to solidify its position on the growing Asian market for nylon products. Thus, the behaviour of HCN-consuming sectors, on par with safety and environmental concerns, will shape the state of the hydrogen cyanide market in future.

More cutting-edge information on the global hydrogen cyanide market can be found in the in-demand research study “Hydrogen Cyanide (HCN): 2022 World Market Outlook and Forecast up to 2031”.