Polyphenylene sulphide (PPS) is a high-performance polymer designed to excel in such characteristics as thermal stability, chemical resistance, mechanical strength, dimensional stability, flame resistance, and ease of processability. As a polymer, it is highly customizable and able to form composites with other materials. Polyphenylene sulphide is applied to make structural parts or to cater to various decisions in the automotive industry (incl. electric vehicles), electronics (incl. 5G sector), electrical/industrial/mechanical appliances, consumer items, medical devices, aviation, sustainability-related domain (e.g. water management), to name only a few. Such functional versatility safeguards a solid foundation for the polyphenylene sulphide market both globally and regionally.

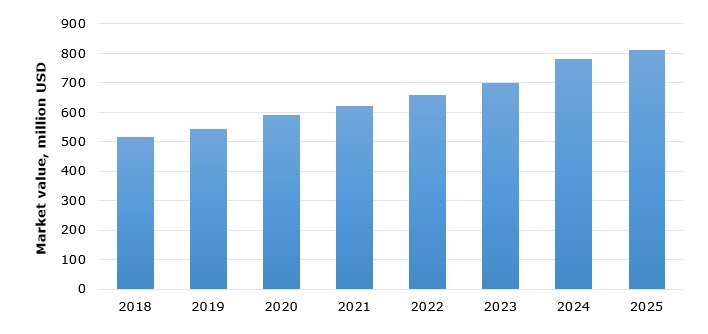

The market is currently growing at a steady pace despite ongoing macroeconomic volatility, sharp increase in the costs of raw materials and energy, further spread of COVID-19, logistics crisis, semiconductor shortage, and political instability. One can ascertain with a high probability that this growth trend will persevere in the nearest future. For instance, the value of the U.S. market for polyphenylene sulphide is expected to grow from about US$500 million in 2018 to over US$800 million in 2025.

Polyphenylene sulphide market value in the United States (2018-2025)

The current steady development of the polyphenylene sulphide market is supported by the strong financial performance of various polyphenylene sulphide manufacturers. For example, in the segment of engineering plastics, Daicel (Japan), which is a major polyphenylene sulphide manufacturer via its wholly-owned company Polyplastics, demonstrated a robust revenue growth (+29.4% y-o-y) in Q4 2021, thanks to a significant rise in demand for cars, mobile devices and augmented sales prices. In 2020, Daicel Daicel completed the acquisition of Polyplastics’ shares from Celanese. Polyplastics manufactures polyphenylene sulphide under the Durafide brand, while Celanese makes and sells its polyphenylene sulphide under the Fortron brand. The most recent price increase for Durafide polyphenylene sulphide occurred in June 2021, when the price was raised by US$0.5 per kg.

All high-performance polymers with extensive portfolios of grades are associated with a significant level of innovation, including in the sustainability-related sector. Polyphenylene sulphide is not an exclusion. For instance, Netherlands-based DSM developed new grades of polyphenylene sulphide (Xytron brand) for a wide variety of applications in water-contact applications. These polyphenylene sulphide grades have nearly no water absorption, so their mechanical properties under water-contact applications remain unchanged. It should be noted that DSM is currently reviewing strategic options for its Materials businesses (to which polyphenylene sulphide production pertains), including a possible change of ownership. In the same vein, Solvay, a multi-specialty chemical company, develops a portfolio of polyphenylene sulphide grades under the Ryton brand to cater to a wide range of high-tech applications, like potable water processing or chemical- and heat-resistant sensor housings used in demanding industrial processes. Likewise, Japan-headquartered Toray Industries developed a high-performance flame-shielding paper using polyphenylene sulphide fibre TORCON. All these facts confirm the deeply innovative character of the polyphenylene sulphide market, which has a strong potential for growth in the future.

More information on the global polyphenylene sulphide market can be found in the comprehensive research report “Polyphenylene Sulphide (PPS) 2022 Global Market Review and Forecast to 2031”.