Calcium chloride (molecular formula: CaCl2) belongs to a class of alkaline earth metal chlorides. It is also a chemical commodity with an extremely wide range of applications. This versatility stems from its useful physical and chemical characteristics, like high hygroscopic potential and excellent solubility in mixing with other liquids. Its aqueous form exhibits a low freezing point, exothermic capacity, and high density. Besides, calcium chloride is relatively inexpensive when compared to alternatives and easily customizable to achieve various concentrations of active ingredients and thus meet specific client requirements.

Calcium chloride is used in the oil and gas industry (incl., in oil well drilling); water treatment (e.g., disposal of oily wastes); freeze conditioning and de-icing; dust control; metal processing and mining (incl. metal recovery); cement, concrete, and gypsum industry (e.g., concrete setting); agriculture (incl. animal feeding, plant nutrition, soil improvement, and fruit/vegetable shelf-life extension); tire industry; electronics (e.g., feedstock for high purity calcium carbonate); refrigeration; food and beverage industry, to name only a few. It is logical that in many of these applications (e.g., agriculture, de-icing, etc.) calcium chloride usage is linked to seasonality. This may enhance the sensitivity of the calcium chloride market to the impact of climate/weather and macroeconomic factors.

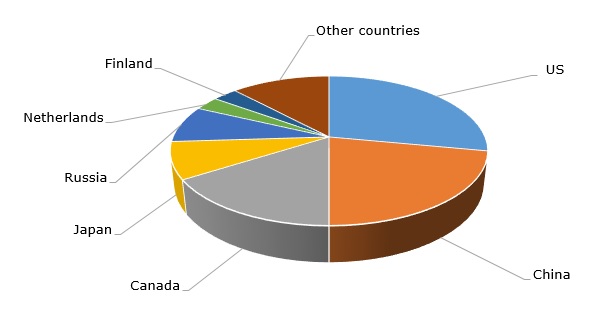

Calcium chloride is manufactured via three pathways: (a) from natural brines, mostly associated with lakes, (b) under a process involving hydrochloric acid neutralization with limestone, and (c) as a by-product of the Solvay process of soda ash production. Key calcium chloride manufacturers can employ any of the three manufacturing routes. For example, Ward Chemical (Canada) and Tiger Calcium Services Inc. (Canada) use brine deposits of the lakes. TETRA Technologies (U.S.) uses food-grade quality hydrochloric acid and high-purity limestone as raw materials. Being major soda ash manufacturers, Qingdao Soda Ash and Fine Chemicals Industrial Co. (China) and Tokuyama Corporation (Japan) employ calcium chloride production coupled with soda ash output. In 2021 global calcium chloride production exceeded 4.4 mln tonnes ($1.33 bn in value terms). The U.S. still operates the world’s largest calcium capacity.

Calcium chloride: structure of the global production capacity by country, 2021

The current trajectory of the calcium chloride market is characterised by a very quick post-COVID recovery amidst serious challenges, like logistical constraints, high energy prices boosting inflationary pressure, shortage of certain raw materials, and perilous geopolitical events. These factors have been mentioned by TETRA Technologies among the key drivers affecting the calcium chloride business of this company. Tetra Technologies is the largest producer of calcium chloride in Europe (with calcium chloride facilities in Finland and Sweden) and the second-largest producer of calcium chloride in the US (after OxyChem). However, despite these challenges the company demonstrated a very robust performance in Q1 2022, though the main growth came mostly from its North American industrial chemicals business. OxyChem demonstrated a similar performance during Q1 2022. These facts confirm a significant level of resilience shown by calcium chloride businesses despite the serious challenges they encounter with.

More information on the global calcium chloride market can be found in the comprehensive research report “Calcium Chloride (CaCl2): 2022 World Market Outlook and Forecast up to 2031”.