Propylene oxide (PO) is an important chemical intermediate used to manufacture a wide range of chemical derivatives (e.g., polyether polyols, propylene glycols, and propylene-based glycol ethers) which are further converted to other derivatives (e.g., urethanes, unsaturated polyesters, etc.) and end-products, like flame retardants, cosmetics, anti-freeze agents, modified carbohydrates (starches), synthetic lubricants, adhesives, paints, oil field drilling chemicals, textile surfactants, to name only a few. This serves numerous consumption sectors, including construction, automotive industry, furniture, bedding, appliances, decorative moulding, athletic equipment, and more.

Propylene oxide is traditionally manufactured either via chlorine (chlorohydrin) or organic peroxide method. The former involves the reaction between propylene and chlorine to produce chlorohydrin, while PO is synthesized by reaction with an alkali. In the organic peroxide method, PO is obtained by indirect epoxidation of propylene using ethylbenzene hydroperoxide. Other PO production methods have been in development for several decades. Propylene oxide production capacity worldwide exceeds 11 mln mty.

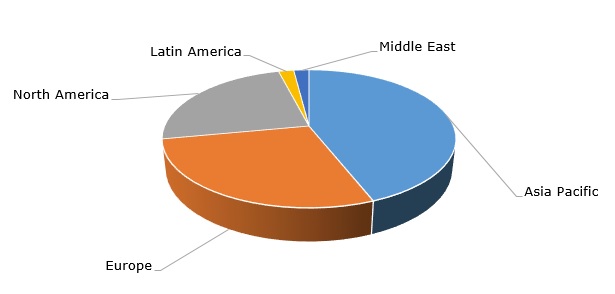

Propylene oxide: structure of the global production capacity by region, 2021

The current propylene oxide market is characterised by the limited availability of this chemical, by rising costs of feedstock, freight, and energy, as well as by mixed dynamics of the PO-consuming sectors. These factors boosted propylene oxide prices in various regions during H1 2022. However, in Q3 and Q4 of 2022, the fear of economic downturn and galloping inflation, both globally and regionally, may undermine the demand for propylene oxide in numerous downstream markets. Possible gas supply curtailments may specifically affect European chemical producers. In addition, the COVID-19 pandemic is known to delay the realization of various projects aimed at propylene oxide capacity expansion. For instance, LyondellBasell has delayed to Q3 2022 the completion of a 450k mty PO plant at its chemical complex in Channelview, Texas (in addition to PO, the unit can manufacture up to 1 mln mty of tertiary butyl alcohol). Once operational, the new PO unit will assist LyondellBasell in catering to various regional markets, predominantly Latin America.

A comprehensive analysis of the global propylene oxide market can be found in the in-demand research study “Propylene Oxide (PO): 2022 World Market Outlook and Forecast up to 2031”.