Methyl methacrylate (MMA) is a monomer and a raw material of acrylic resin. In this capacity, it is an element of complex methacrylate value chains, which may include varied feedstock materials (e.g., isobutylene, ethylene, methanol, and carbon monoxide), MMA itself, polymethyl methacrylate (PMMA), and end products on the basis of (often customised) thermoplastic methacrylate resins. MMA is mainly used to make homopolymers and copolymers (e.g., PMMA) for a wide variety of industries and sectors, namely: construction, advertising signage, the automotive industry, paints and coatings, electronics, medicine, OEM, cosmetics, plumbing, furniture, leather production, to name only a few. This wide applicability depends on the following MMA features: excellent transparency and weatherability, easy recyclability, low-to-moderate toxicity, non-carcinogenic character, and small environmental impact. Global demand for MMA exceeds 3.6 mln mty and is expected to grow at the rate of 3-4% per year in the nearest future.

Since environmental considerations are paramount, methyl methacrylate, known for its environmental friendliness, has good prospects to be competitive in the market for plastics. For example, Mitsubishi Chemical Methacrylates developed a bio-based MMA-manufacturing technology that uses plant-derived materials. A pilot plant using this technology is currently at the design stage and will become operational in 2023 with a goal to enter commercial production in 2026. In 2021, Mitsubishi Chemical Corporation (MCC), the world’s largest producer of methacrylates, united all methacrylate-focused operations under Mitsubishi Chemical Methacrylates entity.

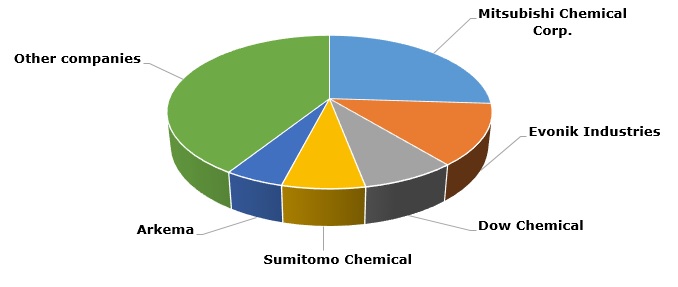

Various sustainability-related plans and programmes are realised by other major MMA producers, like Evonik Industries, Dow Chemical, Arkema, Sumitomo Chemical, and Röhm. All these companies are involved in plastics circular economy, recycling, reducing energy intensity, and low carbon footprint-aimed activities. These activities are supported by corresponding policies, regulations, and legislation in different countries, like amended EU packaging and packaging waste directive 94/62/EC, which soon will be revised. Another vivid example of such regulation is a new bill adopted in California, which decrees that 30% of plastic items sold or bought in that state will be recyclable by 2028, while economic responsibility for this will fall to producers.

Largest MMA producers by production capacity, 2021

This sustainability-related megatrend is confronted by numerous challenges. The energy/feedstock cost hikes and disruptions of supply chains have recently become evident. Röhm announced a price increase for its MERACRYL MMA and other methacrylate monomer products in Europe in spring 2022. The increase was EUR 350 per mt across all grades for all European customers. The demand for MMA remains robust in various regions, like Asia Pacific, North America, and Europe, and different MMA-consuming sectors, despite the global and regional challenges.

More cutting-edge information on the global MMA market can be found in the in-demand research report “Methyl Methacrylate (MMA): 2022 World Market Outlook and Forecast up to 2031”.