Vinyl chloride monomer (VCM) is a vital chemical intermediate embedded in very complex chlor-vinyl production and commodity-provisioning systems. As such, it is an indispensable element within the following commodity chain: feedstock ethane or naphtha (subject to a production route), ethylene, chlorine/caustic soda, ethylene dichloride, vinyl chloride monomer (VCM) itself, polyvinyl chloride (PVC), and a wide range of PVC-based downstream products, applicable in various industries and sectors, predominantly in construction. A small fraction of VCM is used to make polyvinylidene, chlorinated solvents and other commodities. VCM consumption occurs mostly internally, i.e. within vertically integrated manufacture of chlor-alkali products, so only a modicum of produced VCM amount enters spot trade. Major VCM/PVC producers include companies, like Solvay, Formosa Plastics, Shintech, Asahi Glass Company (AGC), Westlake Chemical Corp., Olin and OxyChem. Some of them (e.g. Olin and OxyChem) are able to offer large commercial quantities of VCM globally.

Such complexity and embeddedness in intricate systems boost the VCM market volatility in response to macroeconomic, commercial, technological, manufacturing, seasonal, regulatory, environmental and other factors. The global vinyl chloride market is also a highly competitive one. The current global VCM production capacity is about 60 million mt/y.

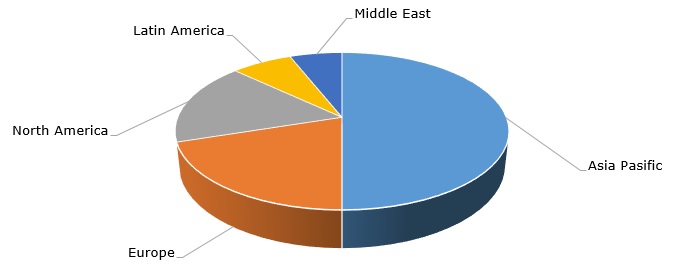

Vinyl chloride: structure of the global production capacity by region

In general, the present dynamics of the global VCM market is dominated by high costs of feedstock and end-products, especially in the construction sector. These costs were driven by rising energy prices and high inflation, (practically in every region of the world), amid global political unrest, which was also contributed by tightening supply and multiple post-Covid-related logistical issues. For example, in Germany the rise in the cost of VCM-based polymers demonstrated a double-digit growth. These scenarios develop against the background of steady demand for chlor-alkali products worldwide (especially in South-East Asia).

The development of regional VCM markets exhibits the same complexity, when different factors interrelate. For example, India remains the world’s fastest growing PVC market with a huge farming sector, which requires extensive networks of irrigation pipes. The start of the agricultural season in this country traditionally drives India’s demand for PVC-consuming piping, which in turn stimulates the demand for vinyl chloride monomer. Meanwhile, India lifted antidumping duties on PVC supplied from Europe (as of late Q3 2022, the duty is considered expired), which may partially address the rising demand for PVC, increase its supply to India and benefit the downstream producers. At the same time, local PVC and VCM producers may soon start to feel the pressure on the sale of their domestically produced VCM and PVC. Reliance Industries Ltd. (RIL) is India’s largest manufacturer of suspension-grade PVC. According to RIL, for instance, in April-June 2022, strong PVC demand in India was supported by soft EDC/VCM prices and robust pre-monsoon agricultural demand, which guaranteed stable PVC prices.

The prospects of the VCM market and of the whole chlor-alkali sector are also associated with sustainability and innovation. A vivid illustration of this trend is a project, which is currently under realization by Oxy and its subsidiary 1PointFive. These companies will build a large-scale carbon capture plant in Texas (US) to reduce emissions and accelerate their paths to a net zero future. If production of VCM and other related products is coupled with such carbon-capturing facilities, the net zero targets can be achievable.

A detailed analysis of the global vinyl chloride market is provided in the in-demand research report “Vinyl Chloride (VCM): 2022 World Market Outlook and Forecast up to 2031”.