Styrene acrylonitrile (SAN) and its blends with other materials belong to a large family of engineering thermoplastic plastics. This type of plastics is mostly used in high-performance applications with rather stringent requirements for their properties. Therefore, styrene acrylonitrile resins are known for their advanced properties in terms of solubility in common solvents; tensile strength; resilience; rigidity; toughness; transparency; processability; as well as thermal and chemical resistance. The excellent performance of SAN plastics is coupled with their relative affordability when compared to other copolymers.

As with other multiple polymers, SAN demonstrates a multi-purpose and versatile nature of functionality. It is used in electrical and electronic equipment, packaging, the automotive industry, healthcare, consumer goods, and home appliances, to name only a few. It is pertinent to mention that the global polymer market production, of which SAN production is an integral part, will exceed 1 billion tonnes by 2050 and is currently worth USD 670 billion (the engineering plastics market hit USD 102 billion in 2022). Of course, within this enormous polymer family, SAN copolymers are not the most popular. For example, when compared to acrylonitrile-butadiene-styrene (ABS) copolymers, the global export volume of ABS in times preceding the Covid pandemic was over USD 8 billion, while SAN export at that time was worth USD 1 billion.

The current dynamics of the SAN market remain mixed and somewhat uncertain amid a very challenging business environment. Some consuming sectors are subdued. For instance, the automotive sector was hit hard by the Covid-19 pandemic, semiconductor chips shortage and other persistent supply chain constraints, high energy and feedstock costs, political and macroeconomic instability, rising inflation, and expectations of the global recession. All these factors weigh on demand, which is currently dwindling especially for durable goods in Europe. Meanwhile, demand in Asia-Pacific is also ebbing, including demand for SAN feedstock materials, like styrene (Asia-Pacific is a leading SAN market). However, SAN-consuming sectors are still able to generate substantial sales, though pre-Covid levels of trade are still not reached (especially in automobiles and electronics), both globally and in many regions. This instability has made various SAN producers, like Trinseo (which delayed the sales of its styrenics business), behave quite cautiously with respect to business decisions, like M&A activities, capacity utilization rates, etc.

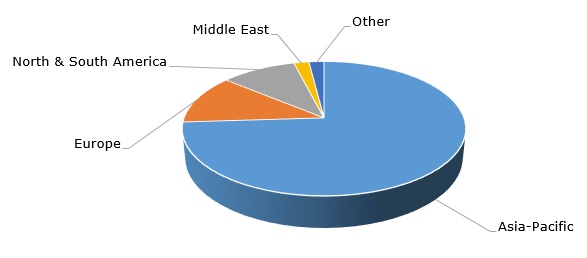

Styrene acrylonitrile: structure of the global consumption by region

The sustainability theme looms large in the operation of various SAN producers. To illustrate this point, one can name the Luran ECO product range, which is a styrene acrylonitrile copolymer jointly developed by INEOS Styrolution and BASF. Luran ECO is based on BASF’s styrene monomer derived from renewable feedstock with a very low carbon footprint. This SAN brand has been gaining popularity and becomes a product of choice for various producers, like Orthex, which is a leading Nordic producer of household products.

A detailed analysis of the global styrene acrylonitrile market can be found in the in-demand research report “Styrene Acrylonitrile (SAN) 2022 World Market Outlook and Forecast to 2031”.