Acrylic acid is an important chemical intermediate within complex production chains where it is typically converted into polymers. Further, these polymers are used in the production of a variety of industrial and consumer goods. Subject to its end use, acrylic acid is subdivided into two broad types or commercial grades: crude or technical grade acrylic acid (used to make acrylic esters, like butyl acrylate, ethyl acrylate, methyl acrylate, etc.) and high-purity, glacial acrylic acid (used to make polyacrylic acid). Globally, about half of produced technical grade acrylic acid is purified to glacial acrylic acid. This proportion between the output of technical and glacial grades of acrylic acid varies between countries. For example, the US production capacity of glacial acrylic acid accounts for over 75% of the total acrylic acid production capacity in this country.

Acrylic acid can be commercially produced by several manufacturing routes, of which catalytic oxidation of petroleum-based propylene via acrolein is the most common pathway. The production of bio-based acrylic acid from renewable sources can be very prospective (e.g., from biologically derived 3-hydroxypropionic acid or by using Procter & Gamble’s technology to convert lactic acid to bio-acrylic acid), but only when commercialization of relevant technologies becomes feasible. The current global consumption of acrylic acid exceeds 6.5 mln mty and is expected to grow by 3-4% annually in the nearest future.

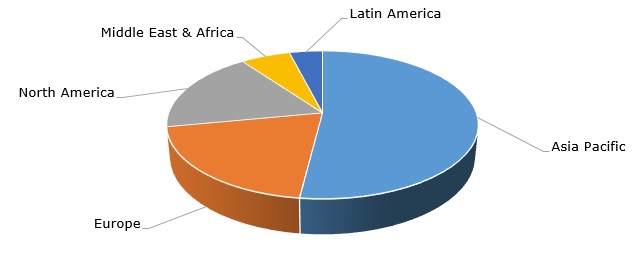

Acrylic acid: structure of the global demand by region

The current dynamics of the acrylic acid market are dominated by surging inflation-driving costs of raw materials, transportation, and energy; global political instability; logistics disruptions and feedstock shortages; manufacturing issues (esp. unplanned outages of cracker facilities); Covid aftermath (incl. some continuing lockdowns in China); as well as some disparities in growth between regions and markets. The current level of demand is not particularly robust due to inflationary pressures and other macroeconomic issues, though the demand for certain types of acrylate esters and specialty acrylates was rather healthy in H1 2022, which was marked by various acrylic acid and acrylate producers. The fact that key acrylic acid producers, like BASF, Dow Chemical Company, Arkema or Evonik Industries, are large, vertically integrated and diversified companies with versatile portfolios of high-performance products and significant innovation potential, acts as a factor that assists in alleviating the above challenges.

A comprehensive analysis of the global acrylic acid market can be found in the in-demand research report “Acrylic Acid: 2022 World Market Outlook and Forecast up to 2031”.