Polybutadiene (polybutadiene rubber or BR, including its high/low cis-trans isomers) and its copolymers with styrene (styrene-butadiene rubber or SBR) account for over 60% of the current total synthetic rubber production, which makes them the most popular synthetic rubbers in the world. The major outlet for BR and SBR is the production of tires, but they are also used in a wide range of technical and consumer rubber goods, like golf balls, running shoes and other footwear, conveyor belts, hoses, etc. Apart from that, other applications of polybutadiene are known, like its use as an impact modifier for polystyrene and acrylonitrile-butadiene-styrene resins.

The importance of BR and SBR as alternatives to natural rubber has been growing, which is evidenced by the explosive growth of their production capacities since World War II. In general, starting from the 1940s all regional rubber markets have undergone significant changes. For example, in the pre-war times, the USA was totally dependent on imports of crude rubber, and several decades later this country became a large exporter of synthetic rubber. Currently, global polybutadiene production capacity reaches almost 4 mln mty, while the SBR market has a production capacity of over 8 mln mty.

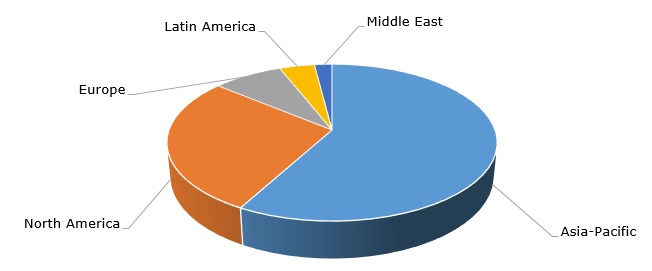

Polybutadiene rubber: structure of the global production capacity by region

The current demand for polybutadiene remains strong in almost all markets despite the challenging automotive industry (the main PBR consumer), which presently has to cope with heavy reductions in car production volumes and semiconductor chip deficit. This situation is likely to persevere in the nearest future. Some companies plan to expand polybutadiene production capacities, which is hardly possible soon. For instance, Indian Oil Corp (IOC) will launch a 60k mty polybutadiene facility, which will come onstream only in 2025. The decision rests on the positive dynamics of the Indian PBR market, driven by robust demand for PBR and the lack of its production capacities.

Many companies are actively engaging in innovation and achieving sustainability goals. These activities may include orientation on high-performance and higher value-added products; development of technologies that will rely on the use of renewable materials; implementation of circular economy and GHG reduction approaches; and responsible energy use. For example, Arlanxeo, a world-leading producer of synthetic rubbers, including polybutadiene rubbers, and a wholly owned subsidiary of Saudi Aramco, is collaborating with Bridgestone and Solvay to develop an innovative platform, known as TECHSYN. TECHSYN will optimize synthetic rubber production, reducing fuel consumption and CO2 emissions, improving tire performance, and cutting raw material consumption. Likewise, Synthos, a global leader in the production of synthetic rubbers, has been developing a technology for the production of bio-butadiene derived from bio-ethanol. To implement this technology, Synthos plans to build a plant with a capacity of 40,000 mty of bio-butadiene.

More cutting-edge information on the global polybutadiene rubber market dynamics and trends can be found in the in-demand research report “Polybutadiene Rubber (BR): 2022 World Market Outlook and Forecast up to 2031”.