Polyvinyl chloride (PVC), represented by a wide range of homo- and copolymers, has laid the groundwork of the modern thermoplastic industry and acts as a workhorse material for multiple consuming sectors. Thanks to its copolymerization capacity for forming blends and compounds with vinyl acetate, vinyl chloride, various plasticizers (esp., bio-based and non-toxic), etc., PVC is able to demonstrate diverse properties, which guarantees it ubiquitous usage in such sectors as engineering, construction, agriculture (esp., in piping applications), healthcare, automotive sector, electrical industry, toys, clothing, footwear, packaging, to name only a few. PVC is processed with the help of different methods, like calendaring, extrusion, injection moulding, pressing, sintering, etc, while the bulk of PVC is commercially manufactured via suspension (S-PVC) and emulsion (E-PVC) polymerization. In general, PVC assists in merging polymer chemistry with chlorine chemistry, and PVC facilities are often integrated with the production of naphtha, ethylene, chlorine/caustic soda, ethylene dichloride (EDC), and vinyl chloride monomer (VCM).

The well-known PVC trade names include Vinnolit (by Westlake Vinnolit), Formolon (by Formosa Plastics), and INOVYN (originally by INOVYN as a JV between INEOS and Solvay, and now by INEOS INOVYN, under full control of INEOS). The current global PVC production capacity exceeds 60 mln mty. In the nearest future, new major capacity additions will come onstream from companies such as Shintech (Shin-Etsu), Xinjiang Zhongtai Chemical Company, Formosa Plastics Group, Tianjin Bohai Chemical Industry Co., Qatar Vinyl Co. (QVC), and some others. In general, the most significant PVC capacity additions are planned in Asia with China alone adding more than 3 mln mty by 2026. China is the world’s largest PVC producer.

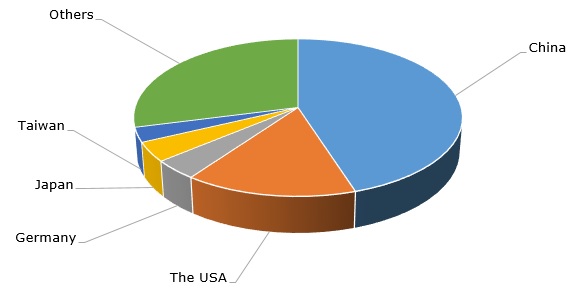

Polyvinyl chloride (PVC): structure of the global production capacity by country

Such expansion plans confirm that the key PVC-manufacturing companies regard the PVC market prospects as promising, while the fundamentals of this market will likely remain robust. This happens despite the current fears of the looming global economic crisis and ongoing challenges, like very high energy and feedstock costs, supply constraints (exacerbated by exogenous factors, like hurricane activities in summer 2022), galloping inflation, deep market uncertainties, and political instability. To illustrate the significance of the current political instability, one can recall Solvay’s decision to suspend its operations and new investments in Russia via its Rusvinyl joint venture with SIBUR.

These challenges are primarily hitting the European chemical market and PVC production in Europe, which is now the most expensive PVC production in the world from the perspective of manufacturing costs. The European chlorovinyls capacity (incl. chlorine, EDC, PVC, and VCM) has been already excessive for quite a long period. This opens good possibilities for Europe’s PVC import from Asia and other regions, where demand weakened over the summer months of 2022 for various reasons. The drop in demand was evident in several large PVC-consuming sectors, like, for instance, home construction in the US and large infrastructural projects in China. All these factors drive the current dynamics of the global and regional PVC markets.

More cutting-edge information on the global polyvinyl chloride (PVC) market performance and trends can be found in the in-demand research report “Polyvinyl Chloride (PVC): 2022 World Market Outlook and Forecast up to 2031”.