Acrylonitrile (ACN) and its polymer blends are vital chemical products used in a wide range of applications, like clothing, car making, electronics and electrical goods, toys, medical items, personal care products, aeronautics, engineering, to name only a few. Acrylonitrile is an indispensable component in forming the company portfolios of synthetic rubber products, synthetic resins, as well as acrylic and modacrylic fibres. As an intermediate, it is used to make various polymers, like acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN), acrylonitrile-butadiene (NBR), adiponitrile and acrylamide. At a commercial scale, acrylonitrile is predominantly produced by the utilization of petrochemical (fossil) resources (mostly via the proprietary fluid-bed propylene ammoxidation process developed by INEOS), while a biomass-based manufacturing route, based on renewable feedstocks, is currently being explored as well (e.g., the bio-ACN project by Solvay and Trillium Renewable Chemicals, or a project planned by Asahi Kasei and its subsidiary Tongsuh Petrochemical Corp. for acrylonitrile production using biomass propylene).

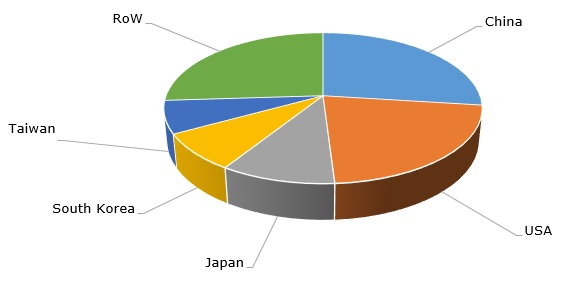

Globally, over 7 million tonnes of acrylonitrile are produced each year, while acrylonitrile overproduction has been evident for a quite prolonged period, despite constant capacity expansions in different regions. To illustrate these expansions, one can name a project originated by PetroChina to launch a 130 ktpa ACN unit and 600 ktpa ABS unit in Jieyang, China, or a 425 ktpa ACN plant to be constructed by INEOS, Saudi Aramco, and Total in Saudi Arabia by 2025. Regionally, the market is dominated by China.

Acrylonitrile: structure of the global production capacity by country, 2021

In Q3 2022, the acrylonitrile market was characterised by subdued demand in multiple consuming sectors, reduced production capacity utilization rates, supply constraints, rising feedstock costs, and a looming energy crisis. Global economic slowdown, inflation, and political instability are currently taking their toll by affecting key producers, especially in Europe and Eastern Europe. The global acrylonitrile market outlook for Q4 2022 seems to maintain the same trajectory as in Q3 2022, though acrylonitrile market fundamentals remain strong, which may be confirmed by a sheer magnitude of acrylonitrile capacity expansion projects that are either planned or are under construction.

More cutting-edge information on the global acrylonitrile market can be found in the in-demand research report “Acrylonitrile (ACN): 2022 World Market Outlook and Forecast up to 2031”.