Hydrogen peroxide (H2O2) is a versatile chemical compound with a range of useful properties, including oxidizing, cleaning, decontaminating, bleaching, and etching, as well as disinfectant, antiviral and anti-bacterial properties. These properties allow using hydrogen peroxide and its solutions in the pulp and paper industry, medical applications, laundry, household cleaning, electronics, food sector, propylene oxide production (via the HPPO process), production of organic peroxides, aquaculture, water treatment, mining, and other areas. Despite various manufacturing routes, hydrogen peroxide is nowadays mostly produced via the anthraquinone auto-oxidation process.

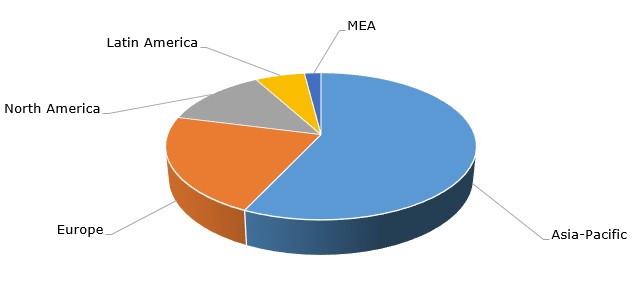

Asia-Pacific accounts for the main share of global hydrogen peroxide production capacities, which currently reached 7 million tonnes per year. That includes various key hydrogen peroxide manufacturers, headquartered not in this region, like Solvay, Evonik, and Arkema, which own and operate a developed network of hydrogen peroxide facilities in the Asia-Pacific region. The consumption of hydrogen peroxide grew globally from 0.5 million tonnes per year in the mid-1980s to over 5 million tonnes per year in 2021.

Hydrogen peroxide: structure of the global production capacity by region, 2021

The current situation in the global and regional markets for hydrogen peroxide is driven by several factors. The energy crisis, macroeconomic and political instability, high inflation rates, and reduced demand in various consuming sectors continue to exert downward pressure on chemical markets. Parallel to that, strong sales in Q1-Q3 2022 demonstrated by key hydrogen peroxide producers, like Solvay, mitigate the above-mentioned adverse impacts.

During the Covid-19 pandemic, the role of hydrogen peroxide as a popular, environmentally friendly, and a rather safe disinfectant for the antiseptic treatment of surfaces has significantly increased. As the Coronavirus disease is very likely to be on the rise during the autumn/winter 2022/2023 period, this role will remain important. Apart from medical applications of hydrogen peroxide, the robust demand for ultra-high purity hydrogen peroxide grades used in semiconductor manufacturing is likely to prevail in the nearest future, despite the turbulent situation in the electronics market. This turbulence mostly stems from the unstable situation of the market. The shortage of semiconductor chips, which was very clearly evident during H2 2022, is now coming to an end and even turning to their overstocking when demand for consumer electronics is weakening.

Despite all these challenges, the prospects of the hydrogen peroxide market remain bright, buoyed by new applications and innovations. The market is driven by the general sustainability and useful properties of this chemical. This trend has become evident since the times of the replacement of chlorine with hydrogen peroxide as a bleaching agent in the pulp and paper industry. The demand for value-added high-purity hydrogen peroxide grades (both in pharmaceutical and electronics applications) will continue to rise.

More reliable data on the global hydrogen peroxide market development, trends, and prospects can be found in the insightful research study “Hydrogen Peroxide (HP): 2022 World Market Outlook and Forecast up to 2031”.