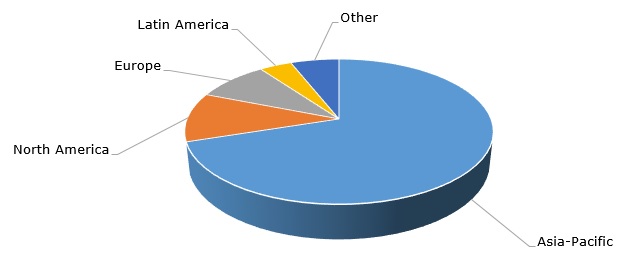

Urea is an important chemical commodity employed in various applications, including agriculture (e.g., plant, soil, and cattle nutrition), industry, pharmaceuticals, and other uses. As a nitrogen-rich organic plant and soil nutrient supplement, urea is an indispensable and valuable fertiliser. Therefore, the use of urea in agriculture is a major outlet for urea consumption. The need to constantly replenish global grain stocks, supported by growing populations, acts as a key driver of demand for nitrogen fertilisers. However, the use of nitrogen fertilisers, especially in the Western World has recently become an arena of stringent state regulation, targeted at the overall reduction of their usage due to environmental concerns. The wicked issue of excess reactive nitrogen pollution and man-caused alteration of the N cycle is more important than ever, especially in light of climate change, land use alteration, and biodiversity losses. Asia Pacific with its enormous agricultural activities is a major urea consumer.

Urea: structure of the global consumption by region

Apart from the environmental considerations, the urea market has always been characterised by increased volatility caused by the interplay of various factors. Among such factors, one can prioritise the following: macroeconomic situation; fertilizer demand and supply fluctuations (oversupply has been tarnishing the urea market for years); urea feedstock prices; urea capacity expansion; seasonality; country-specific agro-sector subsidy policies; fertilizer trade regulation; agricultural cycles; the size of mineralized nitrogen-rich pastures; technological innovations; to name only a few.

The first half of 2022 witnessed limited global urea supply availability due to high natural gas prices. However, in late 2022 the situation is somewhat reversed and is now heading towards oversupply and overstocking. Weaker demand for urea was already evident in Q3 and Q4 2022, coupled with an industrial production slump and an unstable macroeconomic/political situation. Of course, the impact of these factors varies by specific regions, countries, and companies, when some market players were affected more than others or demonstrated different urea market trajectories. In H1 2022, multiple producers, especially in Europe and Asia, had to halt or reduce nitrogen fertilizer production because of gas supply constraints. Europe also increased urea imports. For example, Poland’s Grupa Azoty (urea production capacity: 375k mty) stopped nitrogen fertilizer production for some time in 2022 due to soaring natural gas costs. Lithuanian Achema (urea production capacity: 785k mty) had to temporarily shut down all nitrogen fertiliser production units for the same reasons.

The urea market fundamentals remained robust in North America, buoyed by strong gas supplies, the expectations of high crop prices in 2023, and the need to support rising corn and wheat acreage in the coming year. For example, in 9 months of 2022, CF Industries increased urea sales both in volume and value terms. Nutrien followed the suit with robust performance in nine months of 2022.

China tried to diminish urea exports in an effort to cater to the local agricultural market. This year’s urea exports by China will stay below 2 mln mty. The Chinese government is likely to retain the same urea export-limiting policy in 2023. India increased urea exports in Q1-Q3 2022. However, India’s domestic fertiliser consumption is also significant and acts as an export-constraining factor. Moreover, the European market now struggles with absorbing the urea imported from India in 2022, so its urea-consuming capacity is limited.

More information on the global urea market can be found in the in-demand research study “Urea: 2022 World Market Outlook and Forecast up to 2031”.