Nitrile rubber (also known as nitrile butadiene rubber and acrylonitrile butadiene rubber, abbreviated as NBR) belongs to an extensive group of elastomers and is characterised by a wide-meshed, cross-linked copolymer structure, as well as high resistance to petrol/benzene, acids, alkalines, oils, greases, or fats. Like all rubbers, it is widely used in items for which dynamic properties, like elasticity and tensile strength, are very important (e.g., gloves, conveyer/transmission belts, cables, seals, grommets, O-rings, rollers, hoses, membranes, dampers, linings, etc.). These items serve a myriad of industries and applications, like the medical industry, electronics, footwear, automaking, aviation, construction, industrial equipment, and specialty rubbers, to name only a few. Nitrile gloves, used in medicine (butadiene accounts for 60% of their composition), are favoured for their resistance to punctures and biohazards, as well as for their ability to be used without powder.

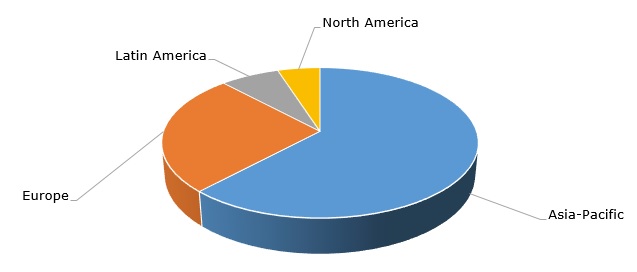

Typical of polymers, nitrile rubbers are highly customizable, subject to the acrylonitrile content, which allows adjusting elasticity, oil resistance, and compatibility with other blends. NBRs with higher acrylonitrile content tend to demonstrate better performance with respect to oil/fuel resistance, tensile strength, and processability, while NBRs with lower acrylonitrile content show better cure rate, resilience, and low-temperature flexibility. The well-known NBR brands include Perbunan and Krynac (both Lanxess), Nipol and Zetpol hydrogenated NBR or HNBR (both ZEON), Europrene (Versalis/Eni), Therban HNBR (ARLANXEO) and KNB (Kumho Petrochemical). In terms of production capacity, the market is significantly dominated by the Asia-Pacific region.

Nitrile rubber: structure of the global production capacity by region, 2022

In 2022, the nitrile butadiene rubber market was hit hard by escalating feedstock and energy prices, (though oil prices are demonstrating a downward trajectory in January 2023), concerns over a global recession, the outburst of COVID cases in China, and global political instability. The market is positively driven by continued demand for NBR-based products in various applications (a significant boost to the market comes from nitrile butadiene consumption of latex gloves for medical and laboratory applications). When LG Chem announced the closure of its 60k mty NBR plant in Daesan in 2021, the company later opted out of this decision. In late 2022, Zeon decided to expand its hydrogenated NBR production capacity at its Texas plant. Likewise, in 2022, ARLANXEO decided to expand its HNBR production capacity in Leverkusen, Germany.

Sustainability has become a global megatrend among all major chemical companies, which aim to reach carbon neutrality or significant reductions in carbon emissions in the foreseeable future, apply strategies of circular economy and try to manufacture their products based on biomass feedstock. All key NBR manufacturers are currently engaged in the realisation of sustainability-driven programmes.

A detailed analysis of the global NBR market can be found in the in-demand research study “Nitrile Rubber (NBR): 2023 World Market Outlook and Forecast up to 2032”.