Iodine is a vital element and an important commodity with a broad range of medical, nutritional, industrial, and other applications. These applications specifically imply diagnostic contrast media, pharmaceuticals, catalysts, optical polarizing films (OPF), iodophors, and biocides in water treatment, to name only a few. As iodine is considered an indispensable element of thyroid hormones, the prevention or even elimination of iodine deficiency disorders, especially among vulnerable categories of people, is of gross significance and is a part of nation-wide and global endeavours of multiple governments and organizations, primarily of the World Health Organization. To this extent, the use and promotion of iodized salt and the balanced uptake of dietary iodine (e.g., dairy products and seafood) have been viewed as practical interventions for the prevention of iodine deficiency. This also acts as a key driver of the demand for iodine in healthcare and nutritional segments. However, despite these iodisation activities in many world regions, the populations of over 50 countries are still affected by iodine deficiency. Different contingencies, primarily associated with nuclear contamination risks, may boost the demand for iodine potassium, which is quite topical in the current unstable political environment.

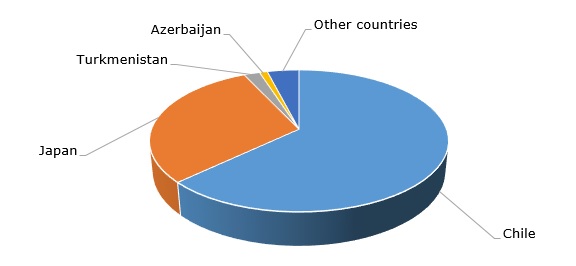

Iodine mine production worldwide is significantly monopolised as two countries, Chile and Japan, account for over 90% of the global elemental iodine production. Chile also remains a major iodine exporter (in 2020, this country exported nearly 20k mt of iodine, worth over US$600 mln). China is the world’s leading importing country of iodine. In 2022, the total global production of iodine exceeded 32,000 mt. Over recent years, this amount of iodine output has been fluctuating to a small degree.

Iodine: structure of the global production by country, 2022

The Covid-19 pandemic adversely affected the sector, leading to the building up of excessive raw iodine inventories. However, starting from 2022, Iofina plc, a major manufacturer of iodine and its derivative products, recorded the overall iodine market invigoration. In 2022 and Q1 2023, the global demand for iodine and iodine-based derivatives was strong, which led to rising iodine prices and improved financial performance of the key players in the iodine market. Despite these positive developments, the iodine market can be confronted by such challenges as a lack of water reserves, as well as rising costs of exploration and mining operations. Therefore, companies like SQM, Algorta Norte, and Iofina plc, are keen to follow the principles of sustainable development to protect scarce water resources and diversify their energy sources.

Find a detailed analysis of the global iodine market in the in-demand research report “Iodine: 2023 World Market Review and Forecast to 2032”.