Polyacetals (polyacetal resins, polyoxymethylene products, or POM) may be structurally categorised as aliphatic polymers and functionally as highly customizable formaldehyde-based engineering thermoplastics. Due to their advanced properties (e.g., excellent mechanical properties, high resistance to wear, low VOC emissions, ease of moldability, or superb thermal and chemical stability), they find application in multiple sectors: electrical and electronic industries, car manufacturing, construction, packaging, sports equipment, gardening, footwear, toys, healthcare, watchmaking, to name only a few. These POM-consuming sectors are currently demonstrating varied dynamics against the background of feedstock price fluctuations, political instability, and recession sentiments in some regions of the world. For example, the strong performance of the European car market in Q1 2023 is now evident, despite supply chain disruptions (e.g., issues with semiconductor chips) and rising energy/feedstock costs.

Popular polyacetals brands are as follows: Delrin (DuPont); Tenac (Asahi Kasei); Amcel, Celcon and Hostaform (Celanese Corp.); Ultraform (BASF); DURACON (Polyplastics/Daicel Group), and Iupital (Mitsubishi Engineering Plastics Corporation). These companies are at the forefront of technological development and research by strategically repositioning their portfolios of polymers for the 21st century, where such elements as innovation, sustainability, and social responsibility are paramount.

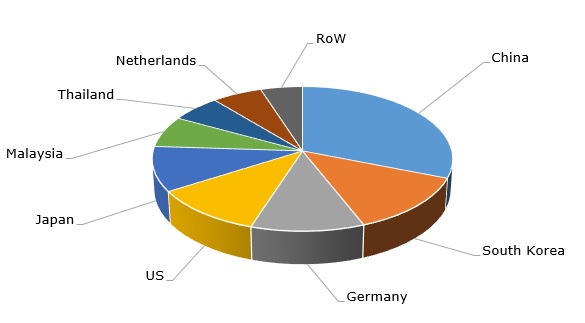

The current production capacity of polyacetal resins is close to 1.8 million mty with a major share of this capacity located in Asia, primarily China, South Korea, and Japan.

Polyacetals: structure of the global production capacity by country, 2022

New polyacetal-producing facilities regularly come onstream in the region. For instance, Polyplastics (now owned by Daicel Group) took a decision to build a new 150k mty polyacetal-manufacturing plant in the Nantong Economic Development Zone of Jiangsu Province, China. This plant will expand the company’s current polyacetal capacity of 290k mty and substitute another decommissioned plant, operated by Polyplastics / Daicel in China. The construction of the new plant will take several years, though the largest share of its production capacity (90k mty) will come onstream already in 2024. Likewise, Celanese Corporation and Mitsubishi Gas Chemical Company recently completed the restructuring of Korea Engineering Plastics, thus bringing Celanese’s POM production capacity in Asia to 70k mty.

As alluded to before, innovation and sustainability are deeply embedded in the polyacetal industry. Polyacetals can be manufactured from renewable feedstock, like biomass. Polyacetal use in biomedical applications has been gaining momentum (e.g., new forms of medicine delivery, tissue regeneration, etc.). Advances in plastic management and circular economy create new opportunities in the polyacetal market.

Find a detailed analysis of the global polyacetals market in the in-demand research report “Polyacetal (Polyoxymethylene, POM) 2023 World Market Outlook and Forecast to 2032”.