The market for the feldspar group of minerals is represented by companies with extensive portfolios of industrial non-metallic minerals and mineral-based solutions. These companies operate across a broad range of industries. The key feldspar-consuming sectors include glass (e.g., automotive glass, solar glass, beverage containers, plate glass, etc.), ceramics, tableware, sanitary ware, fillers and extenders (in applications such as paints, polymers, and rubber), insulation and dentistry. It is estimated that the global feldspar market is currently worth over USD 750 million, while feldspar-based products are consumed within multi-billion industries (e.g., only the global ceramic tile market is valued at over USD 75 billion).

The application of feldspars is largely driven by their quality, which is governed by a combination of feldspar features, like product content, the level of impurities or physical characteristics. The shortage of high-quality feldspars, especially of potassium feldspars or K-feldspars, is common for various regional markets (e.g., North America), despite feldspar’s general abundance. Fine grades of feldspars are greatly valued and are in short supply. For example, they are treasured in ceramic and glass applications due to the strong demand for high-strength specialized glass.

The feldspar market also involves a certain degree of customization. To illustrate this point, one can mention Imerys, a world leader in minerals for ceramic tableware and sanitaryware. The company delivers customizable value-added solutions that are formulated to meet the technical specifications of specific customers. In doing this, Imerys heavily relies on R&D activities. Likewise, SAMCA Group (together with Euroarce, its raw materials division for the ceramic industry) puts great efforts in the research and development of industrial minerals (incl. feldspar), plastic polymers, synthetic fibres, ceramics, and nanotechnology.

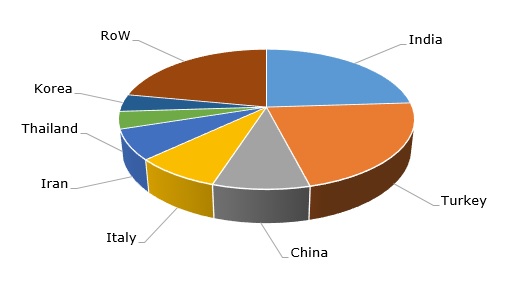

The market for feldspar is quite volatile in terms of mine production volumes (though available statistical data may not reflect the full picture). The country’s leadership in feldspar mine production varies from year to year. In 2022, the top five countries with respect to mine production of feldspars were as follows: India, Turkey, China, Italy, and Iran. In 2018, the top five leaders were almost the same, but their order was different: Turkey, Italy, India, China, and Thailand. Over 40 countries extract feldspars in significant volumes. Feldspar is not traded at commodity exchanges.

World mine production of feldspars by country (2022)

The current situation on the feldspar market remains unstable, largely affected by rising costs (incl., for energy and mining operations) and supply chain disruption. Various manufacturers have to raise feldspar prices. For instance, as of late 2022, Covia (known as Unimin prior to 2018), a wholly owned subsidiary of global industrial minerals company SCR-Sibelco, took a decision to raise prices for various minerals for all non-contracted customers.

Get access to a comprehensive analysis of the global feldspar market in the in-demand research report “Feldspar: 2023 World Market Review and Forecast to 2032”.