Polyphenylene sulphide (PPS) is a crystalline super engineering thermoplastic resin notable for its outstanding physical and mechanical properties, such as high heat and chemical resistance (it can withstand temperatures of over 150°C), excellent mechanical strength and dimensional stability, low toxicity, and flame retardancy. Typical of polymers, it features various molecular weights and could be customised, including via modification with fillers and other polymers. Polyphenylene sulphide is able of forming advanced composites and proprietary blends with various materials (e.g. carbon black, graphite, graphene, nanotubes, etc.), which broadens its application range and creates prerequisites for unique selling propositions, including with respect to pro-environmental concerns. For instance, to reduce GHG emissions, Polyplastics (Daicel), a major manufacturer of polyphenylene sulphide, develops ways of reinforcing its plastics with cellulose, which is a renewable biomass-based raw material. Likewise, in 2023, Toray Industries and Idemitsu Kosan Co. announced plans to develop plastics made from biomass naphtha.

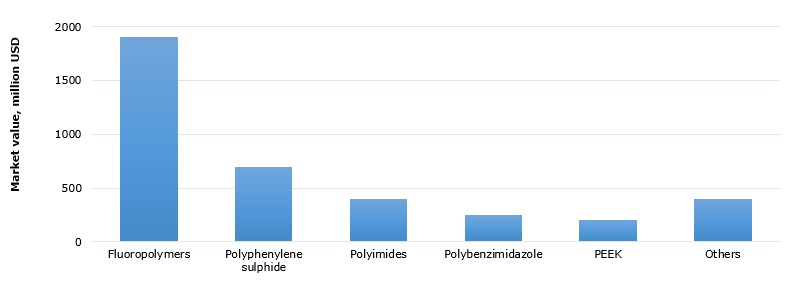

As an advanced material often used in quite harsh and challenging environments, polyphenylene sulphide is employed in many high-tech and innovative sectors, including automotive, electronic/electrical, aerospace, telecommunications, pharmaceutical, consumer/appliance equipment, and other industrial/mechanical uses. It could be processed with the help of various technological modes and could take different forms, i.e. compounds, films, and fibres. Its strong association with innovations in the polymer industry solidifies the potential of polyphenylene sulphide to be used in various prospective applications. All these cater for PPS popularity among other heat-resistant polymers. The figure below shows the US market value of main types of heat-resistant polymers in 2022.

The value of the US market for heat resistant polymers (2022), in million USD

The market prospects for polyphenylene sulphide look quite positive, backed by its popularity among polymers and the robust development of many PPS-consuming sectors. Globally, demand for PPS resin-based compounds is expected to grow by 6% per year in the nearest future. PPS producers also feel quite optimistic in relation to the prospects of its market. For example, Toray Industries, one of the world’s largest players in the field (it manufactures PPS under the TORELINA trademark), plans to boost its overall PPS production capacity to a world-leading – 32,600 mty. To achieve this, the company will expand the PPS production capacity of its facility in Gunsan (Korea) by 5,000 mty from December 2024 (another Toray’s PPS-manufacturing facility is located in Aichi Prefecture, Japan).

A comprehensive analysis of the global polyphenylene sulphide market can be found in the in-demand research report “Polyphenylene Sulphide (PPS) 2023 Global Market Review and Forecast to 2032”.