The term “potash” may refer to the group of potassium-rich salts extracted from subterranean deposits. These salts are vital for plant and animal nutrition. As such, their key area of application is in the form of mineral fertilizers to maintain crop yields and safeguard their quality, resulting in assuring food security. Potash fertilisers may include potassium oxide or K2O (in the narrow sense, the term “potash” may be reserved for potassium oxide), as well as other forms for potash like sulphate of potash or K2SO4 (SOP) and muriate of potash or KCl (MOP or potassium chloride). Muriate of potash is the most widely traded potassium fertilizer, especially popular for the application with chloride-loving vegetables such as corn and sugar beets. In 2022, MOP production exceeded 70 mln tonnes. In terms of potassium nutrient, in 2022, global potash consumption was over 40 mln tonnes. The expected dynamics of potash consumption are likely to be negative, diminishing by about 1% per year in the nearest future, though the future scenarios of the potash market development are hardly predictable in the current unstable market and political environment.

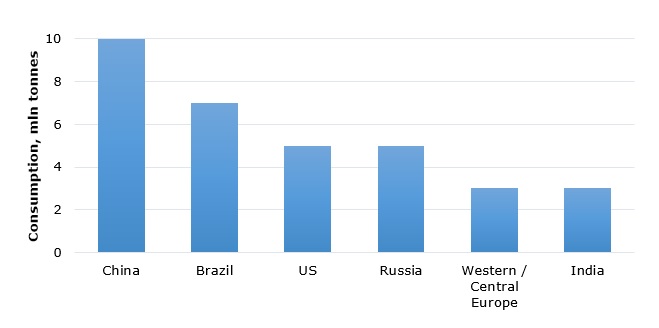

In general, for balanced crop nutrition, potassium application should be coupled with the use of various nutrients (mainly nitrogen/N and phosphate/P) and other microelements. Such combined application often goes in the form of NPK and other complex fertilizers. MOP/SOP fertilisers account for about 60% of total potassium consumption, while NPK fertilizers (about 35%) and other fertilizer types cater for the remaining part of potassium consumption. The key markets for potash consumption are China, Brazil, the US, Russia, Western/Central Europe, and India.

Key potash-consuming markets (2022), in million tonnes of nutrient (K2O)

Potash production is heavily monopolised, with five countries, namely Canada (Nutrien and Mosaic as key players), Russia (Uralkali), Belarus (Belaruskali), China (Salt Lake Potash Ltd. / Sinochem Group), and Germany (K+S), accounting for over 80% of potash output. Nutrien remains the world’s largest potash producer with a nameplate production capacity of over 20 mln tonnes of potash.

The agricultural sector, including fertilizer production, is responsible for a significant share of GHG emissions, while the mineral fertilizer industry and the farming community are often blamed for causing multiple negative effects on ecosystems (e.g. eutrophication of waters due to excessive amounts of leached fertilizer chemicals). As such, both fertilizer manufacturers and farmers try to act responsibly by minimising these adverse impacts and at the same time by recognising resource sustainability, farming needs, and food production requirements, driven by global population growth and socio-demographic changes.

In Q1 2023, the potash market looked somewhat destabilised by post-Covid impacts, logistics disruptions, rising feedstock costs, and global political instability, which affected key potash players, predominantly in Russia and Belarus (both countries will experience a tangible decrease in potash shipments in 2023). The fertilizer shortage, which was evident in different markets in 2022, may affect the production of key crops. Certain improvements in demand for potash were observed in Q1 2023, though buyers are still apprehensive about replenishing their potash inventories, which reduced potash prices in early 2023. The Mosaic Company even reported about the temporary stop of its potash production at the Colonsay mine in Q4 2022 due to the bearish market conditions.

The invigoration of the potash market will occur at the start of the upcoming agricultural season, but global potash shipments in 2023 are expected to be lower as compared to historical trend demand. Notwithstanding these significant challenges, the potash market will be driven by the need to secure food security and robust agricultural market fundamentals. These fundamentals depend on a vast range of variables, representing such important areas as the global macroeconomic environment, fertilizer demand and supply fluctuations, specific agricultural practices, seasonal/weather factors, and technological innovations, to name only a few.

More information on the global potash market can be found in the in-demand research report “Potash: 2023 World Market Review and Forecast to 2032”.