Ethyl acetate (ETAC) is a valuable organic compound, firmly embedded in the acetyls group of petrochemical products. This group comprises such chemical products as methanol/ethanol (as feedstock), acetic acid, vinyl acetate monomer, butadiene acetate, acetic anhydride, and ETAC itself. Due to its excellent solubility, low toxicity, and other useful properties, ETAC is employed in a variety of acrylic, epoxy, urethane, and other formulations, often acting as a solvent or coating. In these roles, ETAC is used by a range of end markets, including furniture, printing inks (e.g., in consumer goods packaging), agriculture, construction and paints, automotive industry, pharmaceuticals and cosmetics, food and beverages (esp., in food flavouring and preservation), leather production, marine applications, to name only a few.

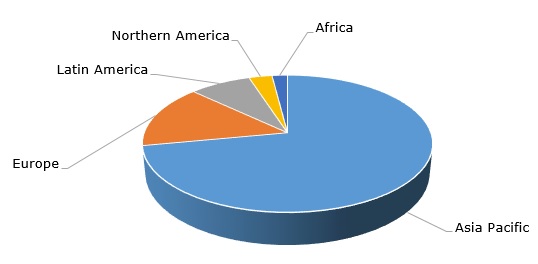

Global demand for ethyl acetate exceeds 4 million tonnes per year, with sales reaching USD 5 billion per year. The compound annual growth rate of the ethyl acetate market is about 5% y-o-y, which surpasses global GDP growth. Ethyl acetate production shows a significant share of regional monopolization with Asia Pacific being a major ETAC-producing region.

Ethyl acetate: structure of the global production by region, 2022

Ethyl acetate is commonly manufactured by esterification of glacial acetic acid and industrial ethanol, as raw materials, or by ethanol dehydrogenation via an acetaldehyde-forming stage. The use of bio-based feedstock in the acetyls chain of products is currently expanding. For example, Celanese Corporation is known for its Eco-B line of acetyl products, including ethyl acetate, with mass-balanced bio-content, which implies blending fossil- and bio-based feedstocks. In the same vein, Daicel Chemical Industries develops the production of ethyl acetate using bioethanol as feedstock.

The current development of the ethyl acetate market demonstrates rather mixed dynamics. On the one hand, the market is rather subdued by economic stagnation and uncertainty, the issues in various ETAC-consuming markets (e.g., automobile production due to semiconductor shortage), rising raw material and fuel prices, soaring global inflation, continuous political instability, logistics disruption, and foreign exchange fluctuations. On the other hand, in Q1 2023, various key ETAC manufacturers, (e.g., Daicel Chemical Industries), recorded an increase in the sales volume of ethyl acetate. However, this positive development may be undermined by subdued demand in multiple regional and consuming markets, as well as by the continuing process of destocking.

Find a detailed analysis of the global ethyl acetate market in the in-demand research report “Ethyl Acetate (ETAC): 2023 World Market Outlook and Forecast up to 2032”.