Nitrobenzene (NB) is an important chemical intermediate in the extensive value chain from benzene via aniline to chemical products such as methylene diphenyl diisocyanate (MDI), used to make rigid polyurethane foams. The nitrobenzene market is tightly coupled with that for aniline. Approximately 95% of produced nitrobenzene is used to make aniline, while nitrobenzene is also involved in the synthesis of azobenzene, benzidine, isocyanates, pyroxylin, and quinoline. Further downstream, nitrobenzene and aniline find application in sectors as diverse as dyes, oils and greases, rubber products, soaps, shoe polishes, adhesives/sealants, packaging, lubricants, perfumery, agricultural chemicals (e.g., plant growth stimulants), textiles, coatings, photographic chemicals, pharmaceuticals (e.g., acetaminophen), electronics and pulp & paper. Therefore, the behaviour of these diverse sectors affects the market for aniline and nitrobenzene, together with their precursors and derivatives.

Nitrobenzene hydrogenation to produce aniline is a very complex reaction that is associated with multiple intermediates and by-products. Many of them, including both nitrobenzene and aniline, are highly toxic. Nitrobenzene is known to be responsible for a number of detrimental effects on humans and animals. Therefore, there are strict measures imposed to regulate its application and exposure, while the use of some nitrobenzene derivatives, like pentachloronitrobenzene employed as a fungicide, is banned in some countries.

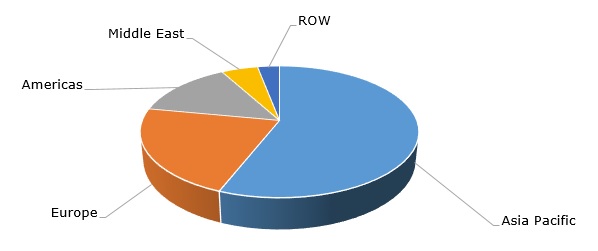

Nitrobenzene: structure of the global consumption by region, 2022

The situation on the nitrobenzene market in Q1 and early Q2 of 2023 was driven by slower global macroeconomic activity due to increasing economic uncertainty, exacerbated by high electricity, gas, and engineering costs. For example, in the US, this adversely influenced the market for industrial intermediates and such sectors as construction, coatings, paints, performance materials, packaging, and specialty plastics (the US nitrobenzene production reaches about 2 million mty; the position of the North American region in global nitrobenzene consumption is relatively modest). To illustrate the point, in Q1 2023, Dow reported a 17% drop in intermediates production as compared to the same period a year earlier. To a certain degree, a similar picture was characteristic of other regional markets. However, despite challenging times, Covestro plans to build a new aniline/MDI-manufacturing plant in Antwerp; the plant will be commissioned in 2025. This signifies strong fundamentals of the MDI market as a key outlet for nitrobenzene and aniline production.

Find more cutting-edge information on the global nitrobenzene market in the comprehensive research report “Nitrobenzene (NB): 2023 World Market Outlook and Forecast up to 2032”.