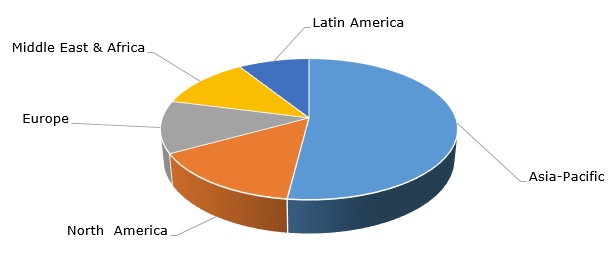

Sulphuric acid is a fundamental chemical building block, which is indispensable for various industries and applications, especially for manufacturing agricultural fertilizers, like monoammonium phosphate, diammonium phosphate, and ammonium sulphate. In general, fertilisers account for nearly 60% of the world’s sulphuric acid consumption, which lays the strong groundwork for the sulphur acid market development. Sulphur is required for balanced crop nutrition, thus safeguarding high crop yields and food security amidst such socio-demographic trends as rising populations and changing lifestyles. Apart from fertilizers, sulphuric acid is used to produce metals, oil, paper, medicines, textiles, batteries, plastics, dyes, perfume, disinfectants and a wide range of chemical products. Global sulphuric acid production exceeds 260 million tons per year. The Asia Pacific region is the largest sulfuric acid market with China’s output at about 100 million tons per year.

Sulphuric acid: structure of the global production by region, 2022

Regardless of the robust fundamentals of this market, the profit margins of sulphuric acid manufacturers may be adversely affected by the interplay of various factors. Fertilizer demand fluctuations, high energy prices, transportation and logistical issues (especially very high freight costs), staggering inflation rates, new regulatory regimes, and macroeconomic instability may foster the bearish mood on the sulphuric acid market. Environmental concerns and sustainability-focused measures, like minimization of carbon footprint and sulphur dioxide emissions, pollution elimination, circular economy, and sustainable governance, stay at the forefront of activities of companies involved in sulphuric acid production and consumption. Sulphuric acid production is mostly linked to high energy-intensive smelter plants and their operators, which act as its suppliers and consumers at the same time. For example, Daye Nonferrous Metals Group Holdings, a subsidiary of China Nonferrous Mining Group Limited, has sulphuric acid production capacity of almost 2.5 million tons per year. The company consumes a certain amount of sulphuric acid for its own production purposes and supplies the rest to the market, including other smelting plants and fertilizer manufacturers.

The current dynamics of the sulphuric acid market remain somewhat mixed. On the one hand, the fertilization season in spring 2023, despite several issues in various regions of the world, demonstrates improvement as compared to the same period a year earlier. Fertilizer prices eased off, while fertilizer demand rose. To illustrate this point, various sulphuric acid manufacturers (e.g., OCP Group, Chemtrade, etc.) reported good results for Q1 2023. On the other hand, the above-mentioned challenges pose significant risks for the sector. For such high-tonnage commodities as sulphuric acid, macroeconomics, transportation costs, and supply-demand relationships play a pivotal role in affecting the market behaviour. This behaviour is often characterised by significant fluctuations in sulphuric acid prices, as it happened in 2022 when sulphuric acid prices hit record highs.

Find a comprehensive analysis of the global sulphuric acid market in the in-demand research report “Sulfuric Acid: 2023 World Market Outlook and Forecast up to 2032”.