Potassium chloride (KCl; muriate of potash or MOP) belongs to the group of mined and manufactured salts that contain the element potassium (K) in water-soluble form. Potassium chloride has approximately 62% of potassium oxide equivalent, which differentiates it from other salts of this group, such as potassium sulphate, potassium-magnesium sulphate, and potassium nitrate. The trio of nitrogen (ammonia), phosphates (phosphoric acid), and potash are the three primary nutrients indispensable for plant growth. Among these three categories of fertilizers, nitrogen holds the most stable position as farmers tend to prioritize nitrogen to preserve their crop yields. So, about 90% percent of potash is consumed in fertilizer application. In 2022, the amount of over 25 million tons of potassium chloride (in K2O equivalent) was consumed globally, which makes it a leader among other potash fertilizers. The non-agricultural uses of potassium chloride include water treatment, animal supplements, glassmaking, cement, de-icing, fire extinguishers, and textiles.

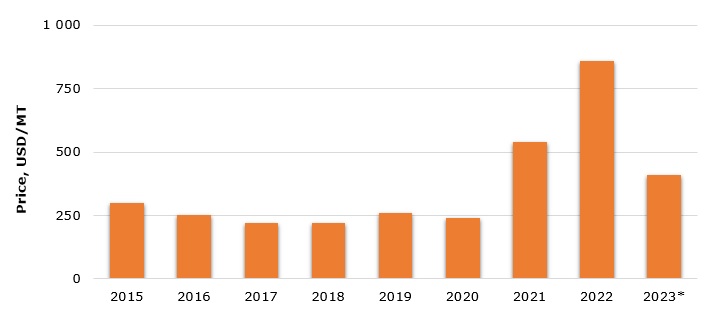

The current development of the potassium chloride market contrasts with that of 2022, which was a very turbulent year for this market. A perfect storm was formed by a combination of various factors. Primarily, the market has still been recovering from Covid-19, which had varying detrimental impacts on the market, especially by compromising the global food security balance and disrupting logistics. Further, geopolitical events adversely affected such key players as Belaruskali and Uralkali, as well as global supply chains in general. High energy and raw material costs exacerbated the issues. In 2022, the whole fertilizer market saw high demand for fertilizers and tightened supply. All these factors led to an unprecedented spike in potassium chloride prices in 2022. Of course, contract prices varied. For example, China’s potash buying committee secured a price of USD590/MT (CFR) with Canpotex (owned by Mosaic, the US, and Nutrien, Canada) for the whole 2022.

Weighted global average prices (in USD/MT) for potassium chloride (* forecasted)

In Q1 and mid-Q2 2023, the picture of the global potassium chloride market was similar in many regions of the world and very different from 2022. It was characterised by lukewarm demand, bearish sentiment, decreased prices, improved logistics, and gradual build-up of potassium chloride inventories. In Q1 2023, average prices were at the level of about USD 480/MT for China, USD 580/MT for Europe, and USD 500/MT for North America. For example, in April 2023, Canpotex agreed to supply potash at a price of USD 422/MT (CFR) to Indian Potash Limited (IPL) until the end of September 2023. In 2022, Canpotex signed Memorandums of Understanding with three top Indian consumers, including IPL, where each of the Indian companies expressed intention to purchase up to 500,000MT of potash annually until late 2025. In general, the global potassium chloride market in the first half of 2023 looks much more stable as compared to the previous several years, though various uncertainties, including geopolitical character or unpredictability of localised agricultural seasons, together with weather conditions, continue to dominate the market sentiments despite some degree of optimism.

Get access to a comprehensive analysis of the global potassium chloride market in the in-demand research report “Potassium Chloride (MOP, Muriate of Potash): 2023 World Market Outlook and Forecast up to 2032”.