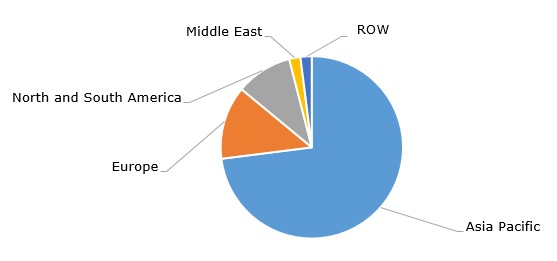

Styrene acrylonitrile (SAN) resins belong to a commercially very important group of thermoplastic polymers. In general, around 60% of styrene output is used to manufacture thermoplastic polymers. The market for styrene acrylonitrile is tightly coupled with that for acrylonitrile-butadiene-styrene (ABS). SAN is characterised by excellent performance with respect to such parameters as chemical/thermal/weather resistance, tensile strength, toughness, transparency, processability, and relative affordability. As such, it is widely used in various applications, including electrical and electronic devices, packaging (e.g., food, pharmaceutical and cosmetic packaging), building materials, automobiles, healthcare, consumer goods, and home appliances. Styrene acrylonitrile is usually produced by suspension polymerization. The preferred ratio of styrene to acrylonitrile is 76/24 parts by weight. The popular SAN brands are manufactured by INEOS Styrolution (e.g., Luran ECO, made using renewable feedstock as compared to standard Luran, made from fossil feedstock-based materials), Formosa Chemicals & Fiber Corporation (Tairasan) and Trinseo (Tyril). Asia Pacific remains the world’s largest SAN-consuming region.

Styrene acrylonitrile: structure of the global consumption by region, 2022

The first half of 2023 witnessed a mixed picture for the styrene acrylonitrile market. On the one hand, the demand weakness and ongoing customer destocking continued to be the prevalent trend, though some SAN-consuming sectors performed well, for example, the automotive industry, mainly in Europe and North America. Partial easing of supply chain constraints and stabilization of energy prices also positively affected the SAN market. However, poor demand for other styrene acrylonitrile-consuming sectors (e.g., construction, industrial applications, and consumer durables) weighed heavily on the market and contributed to the reduction of profit margins. These SAN-consuming sectors were affected by rising inflation and general macroeconomic instability. For instance, in Q1 2023, Trinseo reported a 27% drop in its plastics solutions business segment, though the company anticipates a better performance in Q2 2023 due to an improved economic environment and demand invigoration.

In China, it is anticipated that SAN-consuming sectors, such as home appliances, electronic devices, and automobiles, will demonstrate strong growth in the nearest future. This trend will support the current activities of companies operating in the Chinese market. For example, in Q3 2022, Sinochem International, a leading company in the chemical sector in China (in Europe, it has a SAN-producing subsidiary known as ELIX Polymers), launched a new compounding factory in Yangzhou, China, to reinforce its position in the field of engineering plastics.

Find a detailed analysis of the global styrene acrylonitrile market in the insightful research study “Styrene Acrylonitrile (SAN) 2023 World Market Outlook and Forecast to 2032”.