Butanediol (1,4-butanediol or BDO) is a large-tonnage chemical, which is primarily used to manufacture industrial polymers, such as polyesters and polyurethanes. In this capacity, it acts within complex production chains or networks of derivatives or intermediates. For instance, tetrahydrofuran, which is a key outlet for BDO, is converted to polytetramethylene ether glycol and later to thermoplastic urethane elastomers, Spandex, and copolyester-ether elastomers. Therefore, butanediol is consumed by various industrial and consumer sectors, including car parts, electronics, apparel, sports accessories, and solvents, to name only a few.

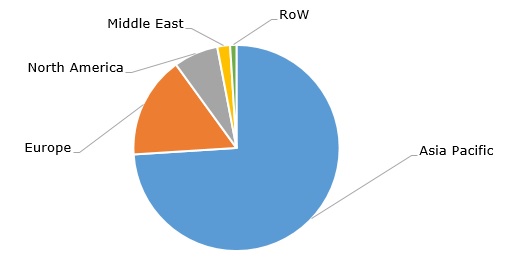

It is currently manufactured from fossil-based petrochemicals, like oil, gas, or coal, via different production pathways, such as an acetylene and formaldehyde reaction (the outdated Reppe process), a butane-to-maleic anhydride route, propylene oxide isomerization, and acetic acid technology. For example, Dairen Chemical Group, (it operates a 700k mty BDO production capacity), uses hydroformylation of allyl alcohol with carbon monoxide and hydrogen. However, butanediol can be also produced sustainably from renewable raw materials, like dextrose. The value of the global butanediol market ranges between US$ 8 billion and US$ 10 billion. Asia Pacific accounts for the largest share of the global BDO market.

Butanediol: structure of the global production capacity by region, 2022

The global chemical market, including the butanediol market, is currently dominated by several key trends and challenges, which adversely affect the chemical markets. Firstly, the reduced demand for various chemicals and destocking dynamics, backed by uncertainty, rising inflation, and ensuing bearish sentiment, are notable almost across all markets, especially in Europe. China starts to experience the same trend amidst its current macroeconomic slowdown. Secondly, the chemical markets (e.g. the market for butadiene) are characterised by overcapacity. Thirdly, the high costs of energy, feedstocks, freight, manufacturing, and logistical operations continue to plague the chemical industry and affect the producers’ profit margins, though some costs and inflation eased slightly in H1 2023. Unsurprisingly, against this background of uncertainty, key butanediol producers in H1 2023 demonstrated varied dynamics with respect to sales volumes and pricing. For instance, in Q1 2023, BASF exhibited a net income increase in its BDO-related segment but recorded a sharp drop in sales volumes at nearly all segments. Likewise, in Q2 2023, a drop in BDO sales was declared by Ashland, a major US butanediol producer with a 65k mty BDO plant in Lima, Ohio, though in its case Ashland observed lower BDO pricing, partially offset by higher volumes. In late 2022 Ashland had to raise its prices for BDO and other chemical products by 15% due to inflation-related costs.

Find a comprehensive analysis of the global butanediol market in the in-demand research report “Butanediol (BDO): 2023 World Market Outlook and Forecast up to 2032”.